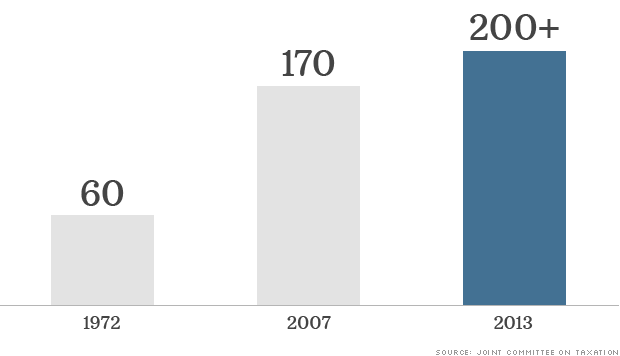

Over

the past 40 years, the number of tax breaks - deductions, credits,

exemptions and other tax benefits - has more than tripled. Tax policy

experts say it's time to rethink many of them.

Over

the past 40 years, the number of tax breaks - deductions, credits,

exemptions and other tax benefits - has more than tripled. Tax policy

experts say it's time to rethink many of them.I know its not my week, but this ARTICLE is pretty interesting...

It seems like these tax breaks will continue to rise and people will be having to pay more for taxes on certain things like insurances and health care.

ReplyDeleteBut with health care and insurance costs so high already how much higher can they go before it starts affecting how our society functions?

ReplyDeleteInteresting that these tax breaks are made to encourage growth in business for all but instead have contributed to concentrating the wealth for few.

ReplyDeleteI have two family members who own huge mulit million dollar businesses and both of them are democrats. Each have told me that taxes aren't that big of a deal to their business and since people spend their money for their business it's only right it goes back into the economy than their wallet.

ReplyDeleteI think there was an article that showed at one point republicans taxed 35% while democrats were 40% and since then its just drastically decreased due to politics.

Like Azia said, this contributes directly towards inequality. Most of these tax breaks benefit the rich, and were probably lobbied for by the rich.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI think another reason taxes are increase is to pay for the health costs and pension of the baby boomer generation. As the cost of healthcare goes up what should be expected of future generations?

ReplyDelete