http://www.scientificamerican.com/article/can-hydrogen-replace-gas/

Check out the article above.

To summarize, there is a new scientific breakthrough that may allow fuel to be created from water instead of oil. What effects would this have on fuel economies? World economies? Financial Crisis?

Wednesday, April 30, 2014

For Joe

If the FCC gets enough public comments against the proposed changes in internet pricing and access, they may cave. Here is a piece on how public comments work in the rule making process. Consider making a short comment if you care about access to the internet.

Everything You Need To Know Before E-mailing The FCC About Net Neutrality – Consumerist

If you feel like you don't understand the issue well enough, take a look at this short piece in the LA Times:

http://www.latimes.com/business/hiltzik/la-fi-mh-murder-of-net-neutrality-20140429,0,3234289.column

Everything You Need To Know Before E-mailing The FCC About Net Neutrality – Consumerist

If you feel like you don't understand the issue well enough, take a look at this short piece in the LA Times:

http://www.latimes.com/business/hiltzik/la-fi-mh-murder-of-net-neutrality-20140429,0,3234289.column

Politics, banks, and housing

Another fascinating account of how politics interacts with lobbying. The GSE's are the government-sponsored enterprises set up in the 1930's to help finance home ownership. They failed in the financial crisis and were taken over and recapitalized by the government (given public dollars to cover the losses and keep them going). Now Congress is trying to decide what to do. One one hand, the American Dream is tied up with home ownership. So consumers have a big stake in making sure homeownership is affordable. The banks want fees and profits. And Congress is stymied. Read the article. It is short.

GSE Reform Dead for Now | naked capitalism

GSE Reform Dead for Now | naked capitalism

It’s Good - no - Great to be the CEO Running a Huge Criminal Bank

This is an article about about the unethical nature of the unequal treatment of banks and bankers. It is written by Bill Black, a forensic accountant who was integral to the prosecutions of bankers in 1980's-early 1990's after the savings and loans banks failed. He dissects both media and governmental language used to excuse fraud. It is a fascinating read.

It’s Good - no - Great to be the CEO Running a Huge Criminal Bank | New Economic PerspectivesNew Economic Perspectives

It’s Good - no - Great to be the CEO Running a Huge Criminal Bank | New Economic PerspectivesNew Economic Perspectives

Tuesday, April 29, 2014

Too big just failed!

Energy Future filed for Bankruptcy and is bound to become one of the biggest Chapter 11 filings in corporate history.

Read the full article here: http://dealbook.nytimes.com/2014/04/29/big-texas-utility-files-for-bankruptcy/?_php=true&_type=blogs&ref=business&_r=0

Why No Outrage Over Apple's Big Bond Deal?

If you borrow the money to buy back your stock and to pay dividends and bonuses it is tax deductible. If you sell product and make profits and then buy back stock and pay dividends, it is taxable. Which would you do?

From Bloomberg:

The interest payments on the bonds will be tax-deductible. All of

this works out nicely for Apple shareholders. Ordinary Americans can

only dream of being able to enjoy such wondrous tax efficiency.

As Floyd Norris of the New York Times wrote in a column

about a year ago: "Isn't that nice of the government? Borrow money to

avoid paying taxes, and reduce your tax bill even further." He also

posed this question: "Could this become the incident that brings on

public outrage over our inequitable corporate tax system?"Considering that Apple is about to do another $17 billion bond deal of this sort, it would seem we have an answer: No.

Why No Outrage Over Apple's Big Bond Deal? - Bloomberg View

From Bloomberg:

The interest payments on the bonds will be tax-deductible. All of

this works out nicely for Apple shareholders. Ordinary Americans can

only dream of being able to enjoy such wondrous tax efficiency.

As Floyd Norris of the New York Times wrote in a column

about a year ago: "Isn't that nice of the government? Borrow money to

avoid paying taxes, and reduce your tax bill even further." He also

posed this question: "Could this become the incident that brings on

public outrage over our inequitable corporate tax system?"Considering that Apple is about to do another $17 billion bond deal of this sort, it would seem we have an answer: No.

Why No Outrage Over Apple's Big Bond Deal? - Bloomberg View

Attacks on the free press in Asia

Bloomberg has a nice piece on freedom of the press in Asia (see here)It outlines problems in one country after another.

Hanif has consistently decried a culture of impunity that is enabled by

the media’s apathy, if not complicity. He has also warned how these

entwined evils steadily creep in from the atrocity-rich borderlands to

the uncaring heartland. “Even in the darkest of times,” Hannah Arendt

once wrote, “we have the right to expect some illumination.” Yet

journalistic institutions, pressured by political, military and

commercial interests, increasingly seem too frail to oblige. The

responsibility falls, frequently and unfairly, on such individual

dissenters as Hanif, whose courage and integrity make them all the more

vulnerable in these dark times.

I would argue that we have much the same process going on in the west. It is not as bloody or violent. And the internet makes it more difficult to suppress information. But the illumination is so often tainted with ideological spin (right, left, middle) that we often want to discount everything.

Hanif has consistently decried a culture of impunity that is enabled by

the media’s apathy, if not complicity. He has also warned how these

entwined evils steadily creep in from the atrocity-rich borderlands to

the uncaring heartland. “Even in the darkest of times,” Hannah Arendt

once wrote, “we have the right to expect some illumination.” Yet

journalistic institutions, pressured by political, military and

commercial interests, increasingly seem too frail to oblige. The

responsibility falls, frequently and unfairly, on such individual

dissenters as Hanif, whose courage and integrity make them all the more

vulnerable in these dark times.

I would argue that we have much the same process going on in the west. It is not as bloody or violent. And the internet makes it more difficult to suppress information. But the illumination is so often tainted with ideological spin (right, left, middle) that we often want to discount everything.

This is the beginning of a recovery....surely

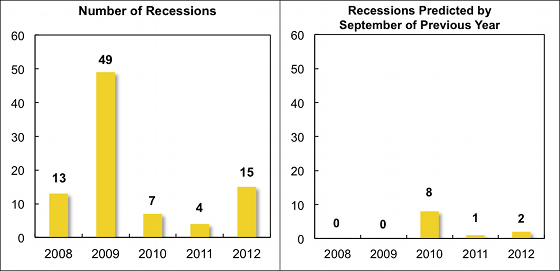

The Wall Street Journal has a piece on the Eurozone today where central bank officials promise to do whatever it takes to beat deflation. The plan appears to be for more QE. Here is a chart that summarizes their problem:

Banks aren't loaning money out. But no worries:

I am a bit skeptical. A normal recession does not create the kind of havoc that the Great Recession has. I'm not sure that income and savings are sufficient to jump start the economy. And yet, it is a business cycle afterall. At some point, things have to improve.

ECB Chief Draghi Banks on New Whatever It Takes - WSJ.com

Banks aren't loaning money out. But no worries:

After all, the measure works by encouraging

businesses and households to borrow and spend. But in the euro zone,

where 70% of corporate finance is provided by banks, bond purchases may

make little difference to the availability of credit because many banks

are still trying to shrink their balance sheets.

businesses and households to borrow and spend. But in the euro zone,

where 70% of corporate finance is provided by banks, bond purchases may

make little difference to the availability of credit because many banks

are still trying to shrink their balance sheets.

Private-sector credit supply continues to contract in the euro zone despite the sharp fall in bond yields this year.

But

if the banking system is in poor shape, why are policy makers

increasingly optimistic about the recovery? Part of the answer is that

too much focus is being placed on credit growth.

if the banking system is in poor shape, why are policy makers

increasingly optimistic about the recovery? Part of the answer is that

too much focus is being placed on credit growth.

One

in five recoveries is "creditless" according to a 2011 International

Monetary Fund working paper. Credit growth remained very subdued for

several years during the recovery from Sweden's financial crisis in the

early 1990s, according to J.P. Morgan research. U.K. bank lending is

only now starting to pick up, more than a year after a strong recovery

began.

in five recoveries is "creditless" according to a 2011 International

Monetary Fund working paper. Credit growth remained very subdued for

several years during the recovery from Sweden's financial crisis in the

early 1990s, according to J.P. Morgan research. U.K. bank lending is

only now starting to pick up, more than a year after a strong recovery

began.

I am a bit skeptical. A normal recession does not create the kind of havoc that the Great Recession has. I'm not sure that income and savings are sufficient to jump start the economy. And yet, it is a business cycle afterall. At some point, things have to improve.

ECB Chief Draghi Banks on New Whatever It Takes - WSJ.com

Monday, April 28, 2014

How Bank of America botched its dividend and capital plan

This is an article to further understand how Bank of America got into the situation that it is now.

http://www.bizjournals.com/charlotte/blog/bank_notes/2014/04/how-bank-of-america-botched-its-dividend-and.html

http://www.bizjournals.com/charlotte/blog/bank_notes/2014/04/how-bank-of-america-botched-its-dividend-and.html

Is there a tech bubble?

I think Utsav asked in class if there is a tech bubble. Here is a video arguing against it. The video is almost 7 minutes, you do not have to watch it all.

Do you agree with the two experts? Are they arguments well supported?

Link: http://www.bbc.co.uk/programmes/p01wzwxf

Do you agree with the two experts? Are they arguments well supported?

Link: http://www.bbc.co.uk/programmes/p01wzwxf

Bank of America Suspends Buyback and Dividend Increase

This is good article for our next class discussion.

http://dealbook.nytimes.com/2014/04/28/bank-of-america-suspends-buyback-and-dividend-increase/?_php=true&_type=blogs&ref=business&_r=0

http://dealbook.nytimes.com/2014/04/28/bank-of-america-suspends-buyback-and-dividend-increase/?_php=true&_type=blogs&ref=business&_r=0

US regulator sues 16 banks for alleged Libor rigging

Here is an interesting article on some banks that are being sued for malpractice. This article voices, to some extent, some of the themes that Admati and Hellwig discuss in Chapter 13 of The Bankers' New Clothes.

http://www.bbc.com/news/business-26584942

http://www.bbc.com/news/business-26584942

Mergers, research, and the long run

This is a great little article about choice. Go to the link and read it. The punchline is given below:

One future is for companies to intensify research in areas of need such

as oncology, exchanging assets in order to concentrate on what they do

best. The other is to succumb to cost-stripping backed by hedge funds

for whom five years is a long time. It is a moral choice.

The future of pharma lies in research, not cuts - FT.com

One future is for companies to intensify research in areas of need such

as oncology, exchanging assets in order to concentrate on what they do

best. The other is to succumb to cost-stripping backed by hedge funds

for whom five years is a long time. It is a moral choice.

The future of pharma lies in research, not cuts - FT.com

Sunday, April 27, 2014

Medicaid Expansion

Pennsylvania Awaits Ruling on Medicaid Expansion

“The request comes in the form of a waiver that the Republican governor has requested as part of his bid to receive additional federal funds for Medicaid, the state-federal program for the poor and disabled.

If approved, Pennsylvania would be the first state to include the work requirement for Medicaid. According to federal regulations, a decision by the U.S. Centers for Medicare and Medicaid Services could come as early as Monday, but Corbett's office says that won't happen.

Points of debate in Corbett's 124-page plan, dubbed Healthy PA, include questions over premium rates and plans to waive both retroactive eligibility and Medicaid's appeals process, which advocates for the poor contend would violate the law.

The Affordable Care Act expands Medicaid expansion to all adults below 138 percent of the federal poverty level, or an additional 454,000 people in Pennsylvania, according to the Kaiser Family Foundation.

Corbett's plan seeks to build on modifications, or "waivers," President Barack Obama's administration has granted in states such as Arkansas and Iowa that allow use of federal Medicaid money to purchase private plans.”

According to the article, the whole premise of this extension is to help individuals break a cycle of poverty, do you agree with that statement? what do you think about the possible extension of Medicaid in Pennsylvania?

Full article at: http://abcnews.go.com/US/wireStory/pennsylvania-awaits-ruling-medicaid-expansion-23489485

Saturday, April 26, 2014

How to tame skyrocketing CEO pay - The Term Sheet: Fortune's deals blogTerm Sheet

A little history on how CEO pay got so large:

How to tame skyrocketing CEO pay - The Term Sheet: Fortune's deals blogTerm Sheet

How to tame skyrocketing CEO pay - The Term Sheet: Fortune's deals blogTerm Sheet

Monopoly kills efficiency and innovation yet again.....

Yesterday, the Wall Street Journal

reported that the FCC is about to release proposed regulations that

would allow broadband providers to charge additional fees to content

providers (like Netflix) in exchange for access to a faster tier of

service, so long as those fees are “commercially reasonable.”... Jon Brodkin of Ars Technica

has a fairly detailed yet readable explanation of why this is bad for

the Internet—meaning bad for the choices available to ordinary consumers

and bad for the pace of innovation in new types of content and

services. Basically it’s a license to the cable providers to exploit a

new revenue source, with no commitment to use those revenues to actually

upgrade service. (With an effective monopoly in many metropolitan areas

and speeds already faster than satellite, the local cable provider has

no market pressure to upgrade service, at least not until fiber becomes

more widespread.) The need to pay access fees will make it harder for

new entrants on the content and services side; in the long run, these

fees could actually be good for Netflix, since it won’t have to worry as

much about competition. The ultimate result will be to lock in the

current set of incumbents that control the Internet, ushering in the era

of big, fat, incompetent monopolies.

How did this happen? The FCC is run by a former industry lobbyist; the big lobby firms are run by fromer FCC regulators and so forth.

I’m Shocked, Shocked! | The Baseline Scenario

reported that the FCC is about to release proposed regulations that

would allow broadband providers to charge additional fees to content

providers (like Netflix) in exchange for access to a faster tier of

service, so long as those fees are “commercially reasonable.”... Jon Brodkin of Ars Technica

has a fairly detailed yet readable explanation of why this is bad for

the Internet—meaning bad for the choices available to ordinary consumers

and bad for the pace of innovation in new types of content and

services. Basically it’s a license to the cable providers to exploit a

new revenue source, with no commitment to use those revenues to actually

upgrade service. (With an effective monopoly in many metropolitan areas

and speeds already faster than satellite, the local cable provider has

no market pressure to upgrade service, at least not until fiber becomes

more widespread.) The need to pay access fees will make it harder for

new entrants on the content and services side; in the long run, these

fees could actually be good for Netflix, since it won’t have to worry as

much about competition. The ultimate result will be to lock in the

current set of incumbents that control the Internet, ushering in the era

of big, fat, incompetent monopolies.

How did this happen? The FCC is run by a former industry lobbyist; the big lobby firms are run by fromer FCC regulators and so forth.

I’m Shocked, Shocked! | The Baseline Scenario

Friday, April 25, 2014

Russia's credit rating downgraded

In class we talked about how Greece, for instance, affected the economic situation of the United States. What is your opinion about Russia’s situation? Do you think it will impact the US? In what way? to what extend? Was the move from the S&P a political motivated decision?

Here is part of the article:

“S&P downgraded Russia's rating to 'BBB-' from ‘BBB'.

Also on Friday, Russia's central bank raised its key interest rate from 7% to 7.5% as it sought to defend the value of the rouble.

Announcing the downgrade, S&P said: "In our view, the tense geopolitical situation between Russia and Ukraine could see additional significant outflows of both foreign and domestic capital from the Russian economy.

Investors have been pulling money out of Russia since last year when the country's economy ran into trouble, but this process has intensified in recent weeks amid concerns over Ukraine.

In the first three months of this year, foreign investors have withdrawn $63.7bn (£37bn) from Russia, and economic growth has slowed significantly - it is expected to grow at no more than 0.5% during 2014.

Russia's central bank said its rate rise was because of a higher inflation risk and the weakness of the rouble. The Russian currency has lost nearly 8% against the dollar this year.

The bank said its move would enable it to lower inflation to 6% by the end of 2014 and added it did not plan on cutting rates in coming months.

Russia's Economy Minister Alexei Ulyukayev dismissed S&P's move, saying that "partially, it is kind of a politically motivated decision”.

Full article at: http://www.bbc.com/news/business-27159423

More on borrowing and budget deficit

Here is an article on the decrease of the EU budget deficit, and the impacts on recovery from the financial crisis.

http://www.bbc.com/news/business-27128112

Any comments, thoughts or questions

http://www.bbc.com/news/business-27128112

Any comments, thoughts or questions

Rising Inequality

Here is a link to a 5 minute video of Thomas Piketty's interview on his book 'Capital in the 21st Century.'

http://money.cnn.com/2014/04/21/news/companies/piketty-best-seller/index.html?iid=SF_E_River

He states that income inequality is inherently not bad. [This reminded me of our discussion about the federal debt and whether we should be concerned about it.] His main argument is that governments need to intervene in order to reduce/eliminate the wideninng income inequality. He also talks about how politics is involved in the widening inequality.

What can governments do to ensure that the policies that will be developed uplifts the majority of the population out of poverty, especially when the rich have more influence in policy making and thus more likely to advocate for policies that serve their self-interest?

http://money.cnn.com/2014/04/21/news/companies/piketty-best-seller/index.html?iid=SF_E_River

He states that income inequality is inherently not bad. [This reminded me of our discussion about the federal debt and whether we should be concerned about it.] His main argument is that governments need to intervene in order to reduce/eliminate the wideninng income inequality. He also talks about how politics is involved in the widening inequality.

What can governments do to ensure that the policies that will be developed uplifts the majority of the population out of poverty, especially when the rich have more influence in policy making and thus more likely to advocate for policies that serve their self-interest?

Gimme cash now.

Here is a wonderful piece on the pitfalls of shareholder activism. In a new world vision, corporations exist to funnel cash to shareholders, not to make things. I doubt this movement toward the financialization of everything will last beyond the next economic crash.

Disgorge the Cash – The New Inquiry

Disgorge the Cash – The New Inquiry

Politics as usual

The best way to run a campaign is to go negative. And the best way to do that is to highlight something said or done in the past:

Miller knows he's up against a well-oiled machine on the pro-Hillary side,

comprised of Ready for Hillary, Priorities USA and Correct The Record,

an offshoot of American Bridge, the opposition research outfit founded

by Clinton ally David Brock. Miller speaks almost reverentially of the

Democratic opposition output that thoroughly outperformed the

Republicans in 2012.

To that end, America Rising has been partially modeled after Brock's

American Bridge, which might be best known for uncovering then-Senate

candidate Todd Akin's comments on "legitimate rape" in 2012. A need was

identified in the Republican post-2012 autopsy, which concluded that

the party didn't have opposition research resources to keep up with the

Democrats. America Rising was founded by Matt Rhoades, a former campaign

manager for Mitt Romney. He was joined by Miller and Joe Pounder, who

were both working at the Republican National Committee.

Now the original and its knockoff are both angling to set the early

scene for 2016. American Bridge is tracking each of the potential GOP

candidates, while America Rising is building a dossier on the Clintons.

Correct The Record, in turn, is monitoring the attacks that Miller and

company launch against Hillary Clinton. "That's a campaign that they're running right now. They're trying to

avoid the accountability that comes with being a candidate," Miller

said. "We're certainly not scared of the Clinton machine. but what we

are conscious of is the need to build something that can counter it."

That effort includes their staff member on the ground in Arkansas as

well as employees in their headquarters in Arlington, Va. They have a

video team that pours through old Clinton footage, a research team on

the analog paper trail and one person dedicated to watching her

appearances on the speaking circuit. And when the midterms are over in

November, more of America Rising's resources will likely go toward the

anti-Hillary campaign.

Meet The Oppo Researchers Who Want To Derail The Clinton 2016 Train

Miller knows he's up against a well-oiled machine on the pro-Hillary side,

comprised of Ready for Hillary, Priorities USA and Correct The Record,

an offshoot of American Bridge, the opposition research outfit founded

by Clinton ally David Brock. Miller speaks almost reverentially of the

Democratic opposition output that thoroughly outperformed the

Republicans in 2012.

To that end, America Rising has been partially modeled after Brock's

American Bridge, which might be best known for uncovering then-Senate

candidate Todd Akin's comments on "legitimate rape" in 2012. A need was

identified in the Republican post-2012 autopsy, which concluded that

the party didn't have opposition research resources to keep up with the

Democrats. America Rising was founded by Matt Rhoades, a former campaign

manager for Mitt Romney. He was joined by Miller and Joe Pounder, who

were both working at the Republican National Committee.

Now the original and its knockoff are both angling to set the early

scene for 2016. American Bridge is tracking each of the potential GOP

candidates, while America Rising is building a dossier on the Clintons.

Correct The Record, in turn, is monitoring the attacks that Miller and

company launch against Hillary Clinton. "That's a campaign that they're running right now. They're trying to

avoid the accountability that comes with being a candidate," Miller

said. "We're certainly not scared of the Clinton machine. but what we

are conscious of is the need to build something that can counter it."

That effort includes their staff member on the ground in Arkansas as

well as employees in their headquarters in Arlington, Va. They have a

video team that pours through old Clinton footage, a research team on

the analog paper trail and one person dedicated to watching her

appearances on the speaking circuit. And when the midterms are over in

November, more of America Rising's resources will likely go toward the

anti-Hillary campaign.

Meet The Oppo Researchers Who Want To Derail The Clinton 2016 Train

Radical thinking by one of the great financial writers of today

Martin Wolf of the Financial Times argues that private banks should not be the entities entrusted with money creation:

Printing counterfeit banknotes is

illegal, but creating private money is not. The interdependence between

the state and the businesses that can do this is the source of much of

the instability of our economies. It could – and should – be terminated....Banking is therefore not a normal market activity, because it provides

two linked public goods: money and the payments network. On one side of

banks’ balance sheets lie risky assets; on the other lie liabilities the

public thinks safe. This is why central banks act as lenders of last

resort and governments provide deposit insurance and equity injections.

It is also why banking is heavily regulated. Yet credit cycles are still

hugely destabilising.

He argues that banks should be highly regulated and references The Banker's New Clothes. Or that fractional reserve banking should be eliminated: banks should hold 100% reserves against deposits.

I am just amazed to see Wolf make these arguments.

Strip private banks of their power to create money - FT.com

Printing counterfeit banknotes is

illegal, but creating private money is not. The interdependence between

the state and the businesses that can do this is the source of much of

the instability of our economies. It could – and should – be terminated....Banking is therefore not a normal market activity, because it provides

two linked public goods: money and the payments network. On one side of

banks’ balance sheets lie risky assets; on the other lie liabilities the

public thinks safe. This is why central banks act as lenders of last

resort and governments provide deposit insurance and equity injections.

It is also why banking is heavily regulated. Yet credit cycles are still

hugely destabilising.

He argues that banks should be highly regulated and references The Banker's New Clothes. Or that fractional reserve banking should be eliminated: banks should hold 100% reserves against deposits.

I am just amazed to see Wolf make these arguments.

Strip private banks of their power to create money - FT.com

Thursday, April 24, 2014

Legal Memo Defends Ackman’s Actions in Allergan Bid

According to this article:

“In the wake of this week’s unusual hostile bid for Allergan, one of the most pressing questions has been whether William A. Ackman, the activist investor who runs Pershing Square Capital Management, engaged in insider trading.

By accumulating a large stake in Allergan while knowing a bid was imminent, Mr. Ackman clearly had an advantage over other investors. And when Pershing Square and Valeant Pharmaceuticals announced its plans, the value of Mr. Ackman’s $4 billion stake quickly rose by about $1 billion. But because Mr. Ackman is part of the buying group, it appears he was well within his legal rights. The fact that the tactic was legal, however, does not mean it is not drawing scrutiny.

Another issue receiving scrutiny in the wake of the bid for Allergan is whether Pershing Square and Valeant should have been forced to disclose the stake they were amassing sooner.

The S.E.C.’s so-called Schedule 13D window stipulates that investors who accumulate 5 percent of a company’s stock must publicly report their position within 10 days of crossing that threshold, but allows the stake to grow in those 10 days.

“For many years numerous market participants have urged Congress to shorten the window, noting that almost every other developed market has a much shorter period to make filings disclosing large positions,” the Cleary lawyers wrote. The Dodd-Frank regulation in 2010 authorized the S.E.C. to close or shorten the 10-day window, but it has not yet acted.

Finally, there is the question of whether Valeant and Pershing Square should have filed antitrust pre-notification under the Hart-Scott-Rodino Act, notifying regulators of a potential merger of rivals. But because Pershing Square mostly bought options, it did not have to report holding underlying shares. Therefore, the Cleary lawyers wrote, “it appears that no filing had been required.”

Though Pershing Square and Valeant appear to have stayed well within their legal rights in accumulating their 9.7 percent stake in Allergan, “this week’s high-profile events regarding Allergan may put pressure on the S.E.C. (and potentially Congress) to address a number of important policy questions,” the memo stated.”

Do you think this is a case of “illegitimate imbalance of information beyond the classic insider trading?” Any opinions about this topic?

What is happening here???

Central banks are keeping interest rates really low. So investors go into riskier investments in the search for yield. Consider Europe:

Europe is seeing a boom in so-called CoCo, or contingent convertible,

bonds issued by banks to shore up capital. Investors in these securities

are wiped out or forced to convert the bonds to stock, if the issuer's

capital falls under a certain threshold, or if regulators consider the

bank ripe for a bailout...The only way to hedge the risk is to buy put options on the issuing

banks' stock or short it, creating the potential for a "death spiral"

should things go wrong. Credit default swaps on CoCos will only become

available in September.Another booming asset class is catastrophe bonds, sold by insurance companies to pass on all sorts of natural disaster risks. These catastrophe bonds bet against damage from named storms in the US....Low interest rates are great for European governments happily increasing their already oppressive

debt burdens. They are also nice for creating the impression that

European economies are growing – at rates scarcely discernible from

zero. Yet glorified bets on U.S. weather patterns and the capital levels

of European banks are inherently shaky investments. And blockbuster

junk bond issues such as Numericable's are downright scary...[Numericable is a European company].

Hunt for Exotic Yields Is Dangerous - Bloomberg View

The problem is that the artificially low nominal interest rates mask the amount of risk involved in all of these activities. What happened to the idea that lower interest rates create incentives for more real investment?

Europe is seeing a boom in so-called CoCo, or contingent convertible,

bonds issued by banks to shore up capital. Investors in these securities

are wiped out or forced to convert the bonds to stock, if the issuer's

capital falls under a certain threshold, or if regulators consider the

bank ripe for a bailout...The only way to hedge the risk is to buy put options on the issuing

banks' stock or short it, creating the potential for a "death spiral"

should things go wrong. Credit default swaps on CoCos will only become

available in September.Another booming asset class is catastrophe bonds, sold by insurance companies to pass on all sorts of natural disaster risks. These catastrophe bonds bet against damage from named storms in the US....Low interest rates are great for European governments happily increasing their already oppressive

debt burdens. They are also nice for creating the impression that

European economies are growing – at rates scarcely discernible from

zero. Yet glorified bets on U.S. weather patterns and the capital levels

of European banks are inherently shaky investments. And blockbuster

junk bond issues such as Numericable's are downright scary...[Numericable is a European company].

Hunt for Exotic Yields Is Dangerous - Bloomberg View

The problem is that the artificially low nominal interest rates mask the amount of risk involved in all of these activities. What happened to the idea that lower interest rates create incentives for more real investment?

Wednesday, April 23, 2014

More about pharmaceuticals!

This is for those who did not know much about the topic of pharmaceutical acquisitions shared in class yesterday.

According to the article, pharmaceutical companies strategy for growth revolves around acquisitions because "productivity for them, while improving, is not improving fast enough."

"Some drug makers regard deal-making as a normal course of business. Allergan’s pursuer is Valeant, a Canadian pharmaceutical company whose growth strategy revolves around acquisitions. On Tuesday, it unveiled its unsolicited takeover bid for Allergan, hoping to create a powerhouse maker of eye-care and cosmetic treatments like Botox.

Based outside Montreal, Valeant has sought to become a major specialty drug maker over the last six years by buying up businesses that are hard to replicate. Its biggest deal to date was last year’stakeover of Bausch & Lomb, the eye-care specialist, for $8.7 billion. Still, it has had its eye on bigger game, first broaching the idea of a merger with Allergan a year and a half ago.

But Valeant’s current approach has raised eyebrows, since it has teamed up with William A. Ackman, an outspoken hedge fund mogul known to fight loudly for change at corporations. The two formed one of the most unusual corporate pairings in recent memory: After reaching a handshake agreement in February to back a takeover bid by Valeant, Mr. Ackman began quietly accumulating shares in Allergan, carefully avoiding tripping rules that would require him to disclose his holdings. On Monday evening, he acquired enough shares to give him control of 9.7 percent of Allergan, giving him a powerful perch from which to demand a merger with his partner.

On Tuesday, Valeant took the cover off its bid, offering cash and stock that was worth about $152.89 a share.

During a nearly four-hour presentation for investors, Mr. Ackman and Valeant executives talked up the benefits of the deal. Combined, Allergan and Valeant would have annual sales of more than $15 billion, while enjoying $2.7 billion in cost savings. And the merged drug maker would benefit greatly from Valeant’s low tax rate.

Both Mr. Ackman and J. Michael Pearson, Valeant’s chief executive, estimated that a combined company would be valued at more than $200 a share.

During the presentation, Mr. Ackman excitedly pointed to what the combined company could do: more mergers.

“We’re looking beyond this transaction,” the hedge fund manager said."

Here is the link to the full article:

http://dealbook.nytimes.com/2014/04/22/ackman-and-valeant-bid-45-6-billion-for-botox-maker/?ref=business

What is your opinion about this topic? Do you think this acquisition tactic will bring some problems in the future? if yes, what kind of consequences?

Delinquent IRS employees paid bonuses by the agency

This article made me think of the discussions we had about compensation pay.

What criteria should be used to determine bonuses?

http://money.cnn.com/2014/04/22/pf/taxes/irs-bonuses/index.html?iid=s_mpm

What criteria should be used to determine bonuses?

http://money.cnn.com/2014/04/22/pf/taxes/irs-bonuses/index.html?iid=s_mpm

Is capitalism driving itself out of business?

I found this interesting article on technological innovation, and the possible long run effect on capitalism. Here is an extract from the article:

"In his latest book, The Zero Marginal Cost Society, Rifkin argues that the private market's drive for efficiency and productivity has brought us ever closer to a world in which the marginal cost to produce just about everything will inch closer and closer to zero.

Picture factories run entirely by robots, powered by renewable energy sources like wind and the sun, creating products delivered by driverless vehicles, also run on renewable energy. Maybe these products won't even need to make any kind of journey at all. Perhaps they can simply be produced at your home or a few blocks away with the help of a 3-D printer.

Speaking of your home, in Rifkin's new world, your next one may very well be built by locally generated, 3-D-printed materials, in record time, removing the considerable expense of transporting construction goods. Rifkin cites an MIT lab that is working to develop a house frame in a single day "with virtually no human labor." An equivalent frame, Rifkin says, "would take an entire construction crew a month to put up."

That home will be powered by -- you guessed it -- increasingly cheap renewable energy, and it will be stocked with more sensors than you can imagine, all feeding data into a smart grid, so your house knows how much energy you need and when, and what needs to be repaired.

This is a technological utopia brought to you by the convergence of what Rifkin calls the Communications Internet (how information is shared), the Energy Internet (how energy needs are shared and energy itself is distributed), and the Logistics Internet (how products are built and delivered), all equaling the so-called Internet of Things.

Granted, the initial cost of building such a system will be substantial. But once it's up and running, Rifkin argues, the benefits will fundamentally reshape our economic order. "The Internet of Things is already boosting productivity to the point where the marginal cost of producing many goods and services is nearly zero, making them practically free," Rifkin writes. "The result is corporate profits are beginning to dry up, property rights are weakening, and an economy based on scarcity is slowly giving way to an economy of abundance."

Link to the article: http://management.fortune.cnn.com/2014/04/23/capitalism-economy-jeremy-rifkin/?iid=s_mpm

Do you agree with his argument? What effects do you think this will have on employment? Any thoughts, comments or questions?

"In his latest book, The Zero Marginal Cost Society, Rifkin argues that the private market's drive for efficiency and productivity has brought us ever closer to a world in which the marginal cost to produce just about everything will inch closer and closer to zero.

Picture factories run entirely by robots, powered by renewable energy sources like wind and the sun, creating products delivered by driverless vehicles, also run on renewable energy. Maybe these products won't even need to make any kind of journey at all. Perhaps they can simply be produced at your home or a few blocks away with the help of a 3-D printer.

Speaking of your home, in Rifkin's new world, your next one may very well be built by locally generated, 3-D-printed materials, in record time, removing the considerable expense of transporting construction goods. Rifkin cites an MIT lab that is working to develop a house frame in a single day "with virtually no human labor." An equivalent frame, Rifkin says, "would take an entire construction crew a month to put up."

That home will be powered by -- you guessed it -- increasingly cheap renewable energy, and it will be stocked with more sensors than you can imagine, all feeding data into a smart grid, so your house knows how much energy you need and when, and what needs to be repaired.

This is a technological utopia brought to you by the convergence of what Rifkin calls the Communications Internet (how information is shared), the Energy Internet (how energy needs are shared and energy itself is distributed), and the Logistics Internet (how products are built and delivered), all equaling the so-called Internet of Things.

Granted, the initial cost of building such a system will be substantial. But once it's up and running, Rifkin argues, the benefits will fundamentally reshape our economic order. "The Internet of Things is already boosting productivity to the point where the marginal cost of producing many goods and services is nearly zero, making them practically free," Rifkin writes. "The result is corporate profits are beginning to dry up, property rights are weakening, and an economy based on scarcity is slowly giving way to an economy of abundance."

Link to the article: http://management.fortune.cnn.com/2014/04/23/capitalism-economy-jeremy-rifkin/?iid=s_mpm

Do you agree with his argument? What effects do you think this will have on employment? Any thoughts, comments or questions?

Whistleblowers beware

Employees of U.S. intelligence agencies have been barred

from discussing any intelligence-related matter _even if it isn’t

classified _ with journalists without authorization, according to a new

directive by Director of National Intelligence James Clapper. Intelligence

agency employees who violate the policy could suffer career-ending

losses of their security clearances or outright termination, and those

who disclose classified information might face criminal prosecution,

according to the directive, which Clapper signed March 20 but was made

public only Monday by Steven Aftergood, who runs the Federation of

American Scientists’ Project on Government Secrecy. Under the

order, only the director or deputy head of an intelligence agency,

public affairs officials and those authorized by public affairs

officials may have contact with journalists on intelligence-related

matters.

The order doesn’t distinguish between classified and

unclassified matters. It covers a range of intelligence-related

information, including, it says, “intelligence sources, methods,

activities and judgments....

“IC employees . . . must obtain authorization for contacts with the

media” when it comes to intelligence-related matters, and they “must

also report . . . unplanned or unintentional contact with the media on

covered matters,” the directive says.

Aftergood said

Clapper’s order could end up hurting the credibility of the U.S.

intelligence community by limiting the discussion of events to what’s

approved by his office. Alternate voices that might call attention to

inaccurate or incomplete statements will be smothered or dissuaded from

speaking out, Aftergood said.

“Whether because of deception or

error or whatever it might be, the authorized official view is not

always the right one and it is usually incomplete,” Aftergood said.

The

U.S. intelligence community already has a substantial record of issuing

inaccurate or abbreviated information to the public, from bogus and

exaggerated information on whether Iraq had weapons of mass destruction

to Clapper’s misleading testimony to Congress on the collection of

Americans’ private communications data.

Read

more here:

http://www.mcclatchydc.com/2014/04/21/225055/us-intelligence-chief-bars-unauthorized.html?utm_source=Sailthru&utm_medium=email&utm_term=%2ASituation%20Report&utm_campaign=SITREP%20APRIL%2023%202014#storylink=cpy

Read

more here:

http://www.mcclatchydc.com/2014/04/21/225055/us-intelligence-chief-bars-unauthorized.html?utm_source=Sailthru&utm_medium=email&utm_term=%2ASituation%20Report&utm_campaign=SITREP%20APRIL%2023%202014#storylink=cpy

I think, by the definition of "media" in the directive, it is conceivable that someone could lose his/her job by speaking to any of us since this is an open blog.

U.S. intelligence chief bars unauthorized contacts with reporters on all intel-related matters | National | McClatchy DC

Housing and the American Dream

Two quick articles here. The first highlights a recent Gallup poll that found that Americans still believe housing is the best long term investment. Is it the American Dream or is it, as Robert Shiller says, a form of irrationality? (see here for story).

Then there is this piece from the LA Times about the number of middle aged people in California who lost their jobs and homes and had to move back in with their parents:

Driven by economic necessity — Rohr has been chronically unemployed

and her husband lost his job last year — she moved her family back home

with her 77-year-old mother.

At a time when the still sluggish economy has sent a flood of jobless

young adults back home, older people are quietly moving in with their

parents at twice the rate of their younger counterparts.

For seven years through 2012, the number of Californians aged 50 to

64 who live in their parents' homes swelled 67.6% to about 194,000,

according to the UCLA Center for Health Policy Research and the Insight

Center for Community Economic Development.

Go here for link .

Then there is this piece from the LA Times about the number of middle aged people in California who lost their jobs and homes and had to move back in with their parents:

Driven by economic necessity — Rohr has been chronically unemployed

and her husband lost his job last year — she moved her family back home

with her 77-year-old mother.

At a time when the still sluggish economy has sent a flood of jobless

young adults back home, older people are quietly moving in with their

parents at twice the rate of their younger counterparts.

For seven years through 2012, the number of Californians aged 50 to

64 who live in their parents' homes swelled 67.6% to about 194,000,

according to the UCLA Center for Health Policy Research and the Insight

Center for Community Economic Development.

Go here for link .

Good summary of Tuesday's discussion points

Simon Johnson, an MIT professor, has written prolifically about the crisis and its aftermath He had a blog piece today that highlights many of the points discussed last night: He points out that almost no one says that the banks are the "right" size. But bank capture of regulators and politicians has made it difficult to resize them and do away with some of the implicit and explicit subsidies. It is a short clearly written post. The link is below.

Read more at http://www.project-syndicate.org/commentary/simon-johnson-points-to-european-governments-as-the-main-obstacle-to-financial-re-regulation#ePB0qjS2CO8uq34D.99

Simon Johnson points to European governments as the main obstacle to financial re-regulation. - Project Syndicate

Operating

big financial firms with small amounts of equity capital and a lot of

debt may be in the interest of their managers, but it is definitely not

in the interest of the rest of society. Moreover, providing large

implicit subsidies to firms that are too big to fail should not be an

attractive policy, because it encourages such firms to take on excessive

risk (and to become even bigger).

big financial firms with small amounts of equity capital and a lot of

debt may be in the interest of their managers, but it is definitely not

in the interest of the rest of society. Moreover, providing large

implicit subsidies to firms that are too big to fail should not be an

attractive policy, because it encourages such firms to take on excessive

risk (and to become even bigger).

CommentsView/Create comment on this paragraphAnd

yet debate about these issues has remained wide open. The question is

no longer so much one of beliefs. Now it is simply about money –

particularly campaign contributions, but also the revolving door between

Washington and Wall Street, as well as the vast pro-megabank interests

that pour millions of dollars into think tanks and other, more shadowy

organizations.

yet debate about these issues has remained wide open. The question is

no longer so much one of beliefs. Now it is simply about money –

particularly campaign contributions, but also the revolving door between

Washington and Wall Street, as well as the vast pro-megabank interests

that pour millions of dollars into think tanks and other, more shadowy

organizations.

Read more at http://www.project-syndicate.org/commentary/simon-johnson-points-to-european-governments-as-the-main-obstacle-to-financial-re-regulation#ePB0qjS2CO8uq34D.99

Simon Johnson points to European governments as the main obstacle to financial re-regulation. - Project Syndicate

Tuesday, April 22, 2014

Piketty and Art

Here is yet another article discussing Piketty's new book that we'll be reading. It extends upon his work and asks questions about how his findings apply to the art industry.

Increasingly, art has become a popular investment among the rich. Historically, this has been the case too, as the exceptionally wealthy have plenty of cash to buy what they want.

Increasingly, art has become a popular investment among the rich. Historically, this has been the case too, as the exceptionally wealthy have plenty of cash to buy what they want.

"Last

year, worldwide auction sales of postwar and contemporary art climbed

to a historic peak of 4.9 billion euros, or $6.8 billion, a massive

increase over the €1.42 billion in auction sales in 2009, according to

the 2014 Art Market Report published by the European Fine Art Foundation

in March."

"So

was the art market then, and is it now, a potent signifier of income

inequality? Attempts to question how the eight- and nine-figure prices

now being paid by billionaires for rectangles of painted canvas might

relate to a wider economic and social context tend to be dismissed by

many working in the art world as the “politics of envy.”

"As

Mr. Piketty points out in his conclusion to “Capital in the

Twenty-First Century,” those who have a lot of money “never fail to

defend their interests.” Those interests are also staunchly defended by

those hoping to make money."

Do you think art is worth as much as it is selling for now? Or do you think it is just being used as a tool that furthers the interests of the wealthy and magnifies income inequality?

Hopefully these articles about Capital are getting you excited about (or less apprehensive) the large book that awaits us at the end of class.

http://www.nytimes.com/2014/04/21/arts/international/Can-an-Economists-Theory-Apply-to-Art.html?_r=0

An end to subprime auto loans?

http://www.cnbc.com/id/101599348

The article gets off to a great start: "U.S. subprime auto lenders are 'exercising more caution,' especially when it comes to higher-risk customers." However, the mood changes throughout the article, ending with: "Nonetheless, there are other indications 'that lenders are still willing to take on increasing risk...So we don't anticipate a major slowdown in subprime lending.'"

I don't know what to make of this. Is it that lenders recognize certain individuals are very high risk and will start to "cautiously" lend to them? This is starting to seem more and more familiar. Is anyone optimistic that they will start to exercise real caution?

The article gets off to a great start: "U.S. subprime auto lenders are 'exercising more caution,' especially when it comes to higher-risk customers." However, the mood changes throughout the article, ending with: "Nonetheless, there are other indications 'that lenders are still willing to take on increasing risk...So we don't anticipate a major slowdown in subprime lending.'"

I don't know what to make of this. Is it that lenders recognize certain individuals are very high risk and will start to "cautiously" lend to them? This is starting to seem more and more familiar. Is anyone optimistic that they will start to exercise real caution?

Monday, April 21, 2014

Income Inequality and Single-Parent Families

This article tries to shed light on an often ignored variable that contributes to income inequality - single parent families. Increases in the divorce rate and births outside of wedlock has resulted in many more single-parent families, and this has very negative effects overall. For reasons discussed in this article, this variable has largely been ignored in the income inequality discussion. I wonder if it will be addressed in Capital. What do you make of this issue? How would you circumvent some of the problems the authors mention?

http://online.wsj.com/news/articles/SB10001424052702303603904579493612156024266?mod=trending_now_1

Some excerpts:

http://online.wsj.com/news/articles/SB10001424052702303603904579493612156024266?mod=trending_now_1

Some excerpts:

"The two-parent family has declined rapidly

in recent decades. In 1960, more than 76% of African-Americans and

nearly 97% of whites were born to married couples. Today the percentage

is 30% for blacks and 70% for whites. The out-of-wedlock birthrate for

Hispanics surpassed 50% in 2006. This trend, coupled with high divorce

rates, means that roughly 25% of American children now live in

single-parent homes, twice the percentage in Europe (12%). Roughly a

third of American children live apart from their fathers."

"Abuse, behavioral problems and psychological issues of all kinds, such

as developmental behavior problems or concentration issues, are less

common for children of married couples than for cohabiting or single

parents, according to a 2003 Centers for Disease Control study of

children's health. The causal pathways are about as clear as those from

smoking to cancer."

"More than 20% of children in single-parent families live in poverty

long-term, compared with 2% of those raised in two-parent families,

according to education-policy analyst Mitch Pearlstein's 2011 book

"From Family Collapse to America's Decline." The poverty rate would be

25% lower if today's family structure resembled that of 1970, according

to the 2009 report "Creating an Opportunity Society" from Brookings

Institution analysts Ron Haskins and Isabel Sawhill. A 2006 article in

the journal Demography by Penn State sociologist Molly Martin estimates

that 41% of the economic inequality created between 1976-2000 was the

result of changed family structure"

The rise of temporary employment

For many Americans, 'temp' work becomes permanent way of life

More and more businesses are starting to hire more temporary employees. The article makes the claim that this is more than a temporary cycle of a recovering economy, it is becoming the new way to run a business. Traditionally, according to this article, as the economy has become more stable, permanent hiring replaces temporary hiring -- however this article believes is not a trend but a permanent change. Do you agree with this? Or do you think businesses will move back toward hiring more permanent workers in the coming months and years?

On another note, the article points out the advantages to businesses for using temporary employees, but what are the disadvantages? Additionally, what, if any, are the advantages to the workforce when businesses use temporary employment (the disadvantages are made quite clear)?

More and more businesses are starting to hire more temporary employees. The article makes the claim that this is more than a temporary cycle of a recovering economy, it is becoming the new way to run a business. Traditionally, according to this article, as the economy has become more stable, permanent hiring replaces temporary hiring -- however this article believes is not a trend but a permanent change. Do you agree with this? Or do you think businesses will move back toward hiring more permanent workers in the coming months and years?

On another note, the article points out the advantages to businesses for using temporary employees, but what are the disadvantages? Additionally, what, if any, are the advantages to the workforce when businesses use temporary employment (the disadvantages are made quite clear)?

Sunday, April 20, 2014

Google and Conspiracy Theories

I've sometimes wondered about how expansive Google is becoming and the enormous amount of information they have about people/companies/everything essentially. They've been displaying interest in new industries as well (e.g. automobile, healthcare).

Does the size and influence of Google concern you? Do you think the government may have to step in at some point if Google's growth continues? Some of the things that the author reveals about Google in this article are surprising in a bad way to me.

http://www.theguardian.com/commentisfree/2014/apr/18/google-alarming-no-conspiracy-theorist

Does the size and influence of Google concern you? Do you think the government may have to step in at some point if Google's growth continues? Some of the things that the author reveals about Google in this article are surprising in a bad way to me.

http://www.theguardian.com/commentisfree/2014/apr/18/google-alarming-no-conspiracy-theorist

Easter Vacation to Boost UK Economy

http://www.marketwired.com/press-release/keeping-the-kids-entertained-this-easter-will-boost-the-economy-by-gbp-2-billion-1898339.htm

A fun little article breaking down the boost to the UK economy Easter may provide. Apparently American parents aren't as fun as those from the UK (at least I couldn't find any data to back them up). Economics is fun!

A fun little article breaking down the boost to the UK economy Easter may provide. Apparently American parents aren't as fun as those from the UK (at least I couldn't find any data to back them up). Economics is fun!

Saturday, April 19, 2014

A reason to get rid of paper money?

Earlier this quarter, a post was made about currencies and the potential for currencies such as bit coin to take over one day.

This post in the WSJ, Why You Shouldn't Put Your Money Where Your Mouth Is, talks about paper money as a mean of spreading illness and disease.

What are your thoughts about the article? Could this speed up the process of 'getting rid of' paper money in the world?

Here is another link to the post

- http://online.wsj.com/news/articles/SB10001424052702303456104579489510784385696?mg=reno64-wsj

This post in the WSJ, Why You Shouldn't Put Your Money Where Your Mouth Is, talks about paper money as a mean of spreading illness and disease.

What are your thoughts about the article? Could this speed up the process of 'getting rid of' paper money in the world?

Here is another link to the post

- http://online.wsj.com/news/articles/SB10001424052702303456104579489510784385696?mg=reno64-wsj

Preview to Piketty

The last book on the syllabus, Capital in the 21st Century, has been making headlines in various news sources that I've read. This NYT article is a bit long, but it is a nice background to the book. I've pulled out some quotes.

Have you guys been coming across references to his work as well? What points that Piketty bring up in this article do you agree/disagree with or are interested to read more about when we get to the book?

http://www.nytimes.com/2014/04/20/business/international/taking-on-adam-smith-and-karl-marx.html?ref=business&_r=0

“This sort of vaccinated me for life against lazy, anticapitalist rhetoric, because when you see these empty shops, you see these people queuing for nothing in the street,” he said, “it became clear to me that we need private property and market institutions, not just for economic efficiency but for personal freedom.” - Piketty on a visit to Romania in 1990

"His book punctures earlier assumptions about the benevolence of advanced capitalism and forecasts sharply increasing inequality of wealth in industrialized countries, with deep and deleterious impact on democratic values of justice and fairness."

"...By debunking the idea that “wealth raises all boats,” Mr. Piketty has thrown down a challenge to democratic governments to deal with an increasing gap between the rich and the poor — the very theme of inequality that recently moved both Pope Francis and President Obama to warn of its consequences."

"As for the Gulf War, it showed him that “governments can do a lot in terms of redistribution of wealth when they want.” The rapid intervention to force Saddam Hussein to unhand Kuwait and its oil was a remarkable show of concerted political will, Mr. Piketty said. “If we are able to send one million troops to Kuwait in a few months to return the oil, presumably we can do something about tax havens.”

"American economists too often narrow the questions they examine to those they can answer, “but sometimes the questions are not that interesting,” he said. “Trying to write a real book that could speak to everyone meant I could not choose my questions. I had to take the important issues in a frontal manner — I could not escape.”

"The rate of growth of income from capital is several times larger than the rate of economic growth, meaning a comparatively shrinking share going to income earned from wages, which rarely increase faster than overall economic activity. Inequality surges when population and the economy grow slowly."

Have you guys been coming across references to his work as well? What points that Piketty bring up in this article do you agree/disagree with or are interested to read more about when we get to the book?

http://www.nytimes.com/2014/04/20/business/international/taking-on-adam-smith-and-karl-marx.html?ref=business&_r=0

“This sort of vaccinated me for life against lazy, anticapitalist rhetoric, because when you see these empty shops, you see these people queuing for nothing in the street,” he said, “it became clear to me that we need private property and market institutions, not just for economic efficiency but for personal freedom.” - Piketty on a visit to Romania in 1990

"His book punctures earlier assumptions about the benevolence of advanced capitalism and forecasts sharply increasing inequality of wealth in industrialized countries, with deep and deleterious impact on democratic values of justice and fairness."

"...By debunking the idea that “wealth raises all boats,” Mr. Piketty has thrown down a challenge to democratic governments to deal with an increasing gap between the rich and the poor — the very theme of inequality that recently moved both Pope Francis and President Obama to warn of its consequences."

"As for the Gulf War, it showed him that “governments can do a lot in terms of redistribution of wealth when they want.” The rapid intervention to force Saddam Hussein to unhand Kuwait and its oil was a remarkable show of concerted political will, Mr. Piketty said. “If we are able to send one million troops to Kuwait in a few months to return the oil, presumably we can do something about tax havens.”

"American economists too often narrow the questions they examine to those they can answer, “but sometimes the questions are not that interesting,” he said. “Trying to write a real book that could speak to everyone meant I could not choose my questions. I had to take the important issues in a frontal manner — I could not escape.”

"The rate of growth of income from capital is several times larger than the rate of economic growth, meaning a comparatively shrinking share going to income earned from wages, which rarely increase faster than overall economic activity. Inequality surges when population and the economy grow slowly."

"Inequality

by itself is acceptable, he says, to the extent it spurs individual

initiative and wealth-generation that, with the aid of progressive

taxation and other measures, helps makes everyone in society better off.

“I have no problem with inequality as long as it is in the common

interest,” he said."

"The last part of the book presents Mr. Piketty’s policy ideas. He favors

a progressive global tax on real wealth (minus debt), with the proceeds

not handed to inefficient governments but redistributed to those with

less capital. “We just want a way to share the tax burden that is fair

and practical,” he said."

Here’s what economic recovery could look like for your family

Here’s what economic recovery could look like for your family

Here's a short article and a video that talks about what a recovered economy would actually look like. What I found particularly interesting, in lieu of our minimum wage increase discussion, is the segment where they talk about the free market driving wages up without any government intervention (starts with about 4 min 15 sec left in the video). Do you think these wages increases will happen across all industries without any government intervention? Anything else in the video or article you strongly agree or disagree with?

Here's a short article and a video that talks about what a recovered economy would actually look like. What I found particularly interesting, in lieu of our minimum wage increase discussion, is the segment where they talk about the free market driving wages up without any government intervention (starts with about 4 min 15 sec left in the video). Do you think these wages increases will happen across all industries without any government intervention? Anything else in the video or article you strongly agree or disagree with?

Get Rich, Live Longer: The Ultimate Consequence of Income Inequality - Derek Thompson - The Atlantic

A nice piece on health outcomes of increasing inequality. One chart really stands out:

The data is from the University of Michigan’s Health and Retirement Study,

a survey that tracks the health and work-life of 26,000 Americans as

they age and retire. The data is especially valuable as it tracks the

same individuals every two years in what’s known as a longitudinal

study, to see how their lives unfold. (see here for link)

Now think about this in the context of social security reform:

When somebody in Washington proposes raising the

retirement age for Social Security or Medicare, he typically says

something like: "We can afford it, because we are living longer." Yes, We can afford it, when the We

in that sentence applies to an audience of white rich old men and women

who really are seeing their lifespans grow by leaps and bounds. But We

doesn't apply to the millions of poor women whose lifespans are

actually declining. Raising the Social Security retirement age

disproportionately reduces lifetime benefits for the very people Social

Security was invented to protect.

The data is from the University of Michigan’s Health and Retirement Study,

a survey that tracks the health and work-life of 26,000 Americans as

they age and retire. The data is especially valuable as it tracks the

same individuals every two years in what’s known as a longitudinal

study, to see how their lives unfold. (see here for link)

Now think about this in the context of social security reform:

When somebody in Washington proposes raising the

retirement age for Social Security or Medicare, he typically says

something like: "We can afford it, because we are living longer." Yes, We can afford it, when the We

in that sentence applies to an audience of white rich old men and women

who really are seeing their lifespans grow by leaps and bounds. But We

doesn't apply to the millions of poor women whose lifespans are

actually declining. Raising the Social Security retirement age

disproportionately reduces lifetime benefits for the very people Social

Security was invented to protect.

Friday, April 18, 2014

Calculated Risk: By Request: Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

Job growth and presidents: who created how many jobs and of what type: public or private sector. Its a short piece and may surprise you.

By Request: Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

Read more at http://www.calculatedriskblog.com/2014/04/by-request-public-and-private-sector.html#Ybzgc4Fuv3mma8wZ.99

Calculated Risk: By Request: Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

Friday, April 18, 2014

By Request: Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Bill McBride on 4/18/2014 08:21:00 PM

Following some comments from Senator Rand Paul, I've been requested to post this again with a couple of tables added.

Senator Paul said last week: "When is the last time in our country we created millions of jobs? It was under Ronald Reagan ..."

Senator Paul said last week: "When is the last time in our country we created millions of jobs? It was under Ronald Reagan ..."

Read more at http://www.calculatedriskblog.com/2014/04/by-request-public-and-private-sector.html#Ybzgc4Fuv3mma8wZ.99

Senator Paul said last week: "When is the last time in our country we created millions of jobs? It was under Ronald Reagan ..."

That is completely wrong.

Read more at http://www.calculatedriskblog.com/2014/04/by-request-public-and-private-sector.html#Ybzgc4Fuv3mma8wZ.99

That is completely wrong.

Read more at http://www.calculatedriskblog.com/2014/04/by-request-public-and-private-sector.html#Ybzgc4Fuv3mma8wZ.99

Senator Paul said last week: "When is the last time in our country we created millions of jobs? It was under Ronald Reagan ..."

That is completely wrong.

Read more at http://www.calculatedriskblog.com/2014/04/by-request-public-and-private-sector.html#Ybzgc4Fuv3mma8wZ.99

That is completely wrong.

Read more at http://www.calculatedriskblog.com/2014/04/by-request-public-and-private-sector.html#Ybzgc4Fuv3mma8wZ.99

Calculated Risk: By Request: Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

Renting vs. Buying a Home

This is an interesting interactive map showing whether it is better to rent or buy homes. The data compares average monthly rent to average monthly mortgages. Does the data surprise you? Or is it what you would expect? It was not too surprising to me.

http://www.marketwatch.com/story/rent-or-buy-this-map-has-the-answer-2014-04-18

http://www.marketwatch.com/story/rent-or-buy-this-map-has-the-answer-2014-04-18

To big to be held liable

Just how far does the bailout go? This article describes how GM may dodge liability for defective cars produced before the company went bankrupt. GM is trying to claim that the "New GM" is a separate legal entity from "Old GM" and as such is not liable to compensate customers (or at least the compensation should be limited) for defective ignition switches in older models.

What are your thoughts on this claim? Though it will be looked at as a legal issue, the case has strong economic implications. Would a ruling in favor of "New GM" encourage large corporations to continue to operate under the assumption of the too big to fail? Could GM create a new theory here - too big to be liable?

Thursday, April 17, 2014

Full Emplyment within Sight?

http://www.marketwatch.com/story/yellen-plausible-economy-restored-in-two-years-2014-04-16-1291253

Janet Yellen, chair of the Federal Reserve, recently gave a speech in which she expressed her belief that a return to full employment is "quite plausible" within the next two years. This article provides a brief discription of the speech (and provides a link to a more detailed write up). Do you agree with Yellen? How likely to you think a return to full employment is within the next two years?

Janet Yellen, chair of the Federal Reserve, recently gave a speech in which she expressed her belief that a return to full employment is "quite plausible" within the next two years. This article provides a brief discription of the speech (and provides a link to a more detailed write up). Do you agree with Yellen? How likely to you think a return to full employment is within the next two years?

Infographic about the Federal Reserve

This is a pretty nice infographic. Despite all that we've talked about, a little review on the Fed's organization and history is helpful.

http://dailyinfographic.com/how-the-federal-reserve-system-really-works-infographic

Has anybody been paying attention to Yellen's recent comments? This second article is a bit longer, but it summarizes what she said on Monday -

http://www.nytimes.com/2014/04/17/business/economy/yellen-speech-federal-reserve.html?partner=rss&emc=rss

http://dailyinfographic.com/how-the-federal-reserve-system-really-works-infographic

Has anybody been paying attention to Yellen's recent comments? This second article is a bit longer, but it summarizes what she said on Monday -

http://www.nytimes.com/2014/04/17/business/economy/yellen-speech-federal-reserve.html?partner=rss&emc=rss

A nice straight forward piece on the pros and cons of high frequency trading

Joesph Stiglitz is quoted a lot in this piece that is well worth reading. A snippet:

Better “nanosecond” price discovery comes at the expense of a

market in which prices reflect less well the underlying fundamentals.

As a result, resources will not be allocated as efficiently as they

otherwise would be.Because one reason that market

efficiency matters is that prices are a signal to companies about where

they should invest. Facebook's recent purchases,

for instance, tell entrepreneurs that developing new messaging apps is

an order of magnitude more valuable for society than is developing

virtual reality.2

And high-frequency trading does not do much for those signals, because,

you know, the usual: High-frequency trading happens faster than you can

blink, and the people deciding what real investments to make are too

busy blinking to pay attention to it.

The big argument is that financial gains by high frequency traders result in losses to investors in the real economy.

How Much Trading Should There Be? - Bloomberg View

Better “nanosecond” price discovery comes at the expense of a

market in which prices reflect less well the underlying fundamentals.

As a result, resources will not be allocated as efficiently as they

otherwise would be.Because one reason that market

efficiency matters is that prices are a signal to companies about where

they should invest. Facebook's recent purchases,

for instance, tell entrepreneurs that developing new messaging apps is

an order of magnitude more valuable for society than is developing

virtual reality.2

And high-frequency trading does not do much for those signals, because,

you know, the usual: High-frequency trading happens faster than you can

blink, and the people deciding what real investments to make are too

busy blinking to pay attention to it.

The big argument is that financial gains by high frequency traders result in losses to investors in the real economy.

How Much Trading Should There Be? - Bloomberg View

This one is for Mark

Junk Food:

India is striving to understand the health impacts of junk food on children. A working group was set up to do some research and make recommendations for regulating junk food availability and labeling. Here are some quotes:

“There is nothing called junk food. The problem with obesity lies

with children who do not exercise enough. What is needed is for them to

run and jump, and to do this they need to consume high-calorie food. So,

food high in salt, sugar and fat is good for them.” This is what was

argued vehemently and rudely by representatives of the food industry in

the committee, set up under directions from the Delhi High Court to

frame guidelines for junk food in the country.

On the face of it there was no one from the junk food industry in the

committee. In the early meetings, we only knew that there were members

of two associations who were representing the food industry in the

committee. But as discussions got under way, it became clear that the

big junk food industry was present in the meeting. We learnt that the

member representing the National Restaurant Association of India was a

top official from Coca-Cola—the world’s most powerful beverage company

that is at the centre of the junk food debate globally. The other

grouping, All India Food Processors Association, was represented by

Swiss food giant Nestle, which has commercial interest in instant

noodles and other junk food.....

The question before the working group was not whether action was

needed, but how to address these concerns. The first step was to build