American regulators intend to ensure that foreign banks operating in the United States have adequate capitalization.

The idea was that the presumably well-capitalized parent back home would stand behind the American operation if it ran into trouble. And the United States could, of course, rely on home countries to both regulate their banks and, if something went badly wrong anyway, provide bailouts.

The rules would require that American subsidiaries of each foreign bank be put together in a holding company that would have to maintain capital, and liquidity, in the United States. In some cases the requirements would be greater than home countries require of the parent institutions.

Read More: http://www.nytimes.com/2013/04/26/business/foreign-banks-in-us-face-greater-restrictions.html?pagewanted=all

Tuesday, April 30, 2013

Affordable Care Act (Obamacare)

The ACA makes dramatic changes to the way millions of Americans access health care. This comprehensive reform of health insurance attempts to make insurance more affordable, higher in quality and more accessible for people. It also expands Medicaid, imposes new responsibilities on individuals to purchase insurance and provides new incentives for employers to provide insurance for their employees. Together, these changes are estimated to expand coverage to 32 million people who were previously uninsured......

As of September 23, 2010, a number of insurance reforms went into effect, including requiring insurers to:

Health Insurance 101

As of September 23, 2010, a number of insurance reforms went into effect, including requiring insurers to:

- Cover certain preventive services without deductibles or cost-sharing

- Allow parents to keep adult children up to age 26 on their insurance

- Cover all children under the age of 19, regardless of health status

- Create an internal and external appeals process to handle consumer complaints and denials

- Eliminate lifetime limits on benefits and significantly raise the annual limits for benefits (eventually it will also eliminate annual limits)

- Spend a minimum of 80 percent of premiums on medical services and quality improvement

- Justify unreasonable premium increases

- Eliminate the practice of rescissions (when a health plan retroactively cancels coverage after the enrollee gets sick)

- Allow patients to choose their health care professional as a primary care provider

Health Insurance 101

Increased profits from decreasing costs and revenues

One of the big problems in the U.S. economy right now is that big corporations are generating record profits not by growing revenues but by cutting costs. "Costs," as everyone who works for a big corporation knows, are a synonym for employees, employee wages, employee perks, capital investment, and research and development.As a result, we have reached a point where corporate profit margins are at all-time highs and corporate wages are at all-time lows as a percent of the economy. (See charts here.)....The employees whose collective wages are stagnant or dropping account for most of the spending that drives the economy. So if employees aren't getting paid well, and corporations aren't spending, the economy can't grow quickly....Gary Shilling is right that today's record-high profit margins and labor-capital imbalance won't persist, because it never does. But the question companies should be asking themselves is how they want this imbalance to be addressed. Do they want to wait until they are forced to share more of their wealth by unions or the government? Or do they want to do it voluntarily, because it's the right thing to do and because it's better for them and their shareholders in the long run?

Monday, April 29, 2013

China GDP Growth Slows to 7.7%

BEIJING—China's economic growth slowed unexpectedly in the first quarter, raising concerns that a recovery that started in the second half of last year is already losing steam.

With the recovery in the U.S. economy still weak, and problems in Cyprus underscoring Europe's lingering debt issues, disappointing growth in China could cast a pall over the global investment outlook.

"The new government has concentrated more on raising the quality of economic growth," said Sheng Laiyun, spokesman for China's National Bureau of Statistics. He added that "7.7% is not a low growth rate given the global and domestic situation, and it's good for companies' restructuring and industrial upgrading."

The economy showed further signs of slowing at the end of the quarter. Industrial output growth decelerated to 8.9% year-on-year in March, down from 9.9% in February. Retail sales also disappointed, with growth at 12.6% year-on-year in March, suggesting cautious households are being slow to support the government's goal of raising domestic consumption.

Read More: http://online.wsj.com/article/SB10001424127887323346304578423431110506270.html

What will happen to the global economy if China's GDP continues to fall? Is the government responding correctly? And if not, what kinds of policies should they be using? #thoughts?

With the recovery in the U.S. economy still weak, and problems in Cyprus underscoring Europe's lingering debt issues, disappointing growth in China could cast a pall over the global investment outlook.

"The new government has concentrated more on raising the quality of economic growth," said Sheng Laiyun, spokesman for China's National Bureau of Statistics. He added that "7.7% is not a low growth rate given the global and domestic situation, and it's good for companies' restructuring and industrial upgrading."

The economy showed further signs of slowing at the end of the quarter. Industrial output growth decelerated to 8.9% year-on-year in March, down from 9.9% in February. Retail sales also disappointed, with growth at 12.6% year-on-year in March, suggesting cautious households are being slow to support the government's goal of raising domestic consumption.

Read More: http://online.wsj.com/article/SB10001424127887323346304578423431110506270.html

What will happen to the global economy if China's GDP continues to fall? Is the government responding correctly? And if not, what kinds of policies should they be using? #thoughts?

Annual income of richest 100 people enough to end global poverty four times over | Oxfam International

Extreme inequality is not just a problem in the US.

The $240 billion net income in 2012 of the richest 100 billionaires would be enough to make extreme poverty history four times over, according Oxfam’s report ‘The cost of inequality: how wealth and income extremes hurt us all.’ It is calling on world leaders to curb today’s income extremes and commit to reducing inequality to at least 1990 levels. The richest one per cent has increased its income by 60 per cent in the last 20 years with the financial crisis accelerating rather than slowing the process.

Oxfam warned that extreme wealth and income is not only unethical it is also economically inefficient, politically corrosive, socially divisive and environmentally destructive.

Annual income of richest 100 people enough to end global poverty four times over | Oxfam International

The $240 billion net income in 2012 of the richest 100 billionaires would be enough to make extreme poverty history four times over, according Oxfam’s report ‘The cost of inequality: how wealth and income extremes hurt us all.’ It is calling on world leaders to curb today’s income extremes and commit to reducing inequality to at least 1990 levels. The richest one per cent has increased its income by 60 per cent in the last 20 years with the financial crisis accelerating rather than slowing the process.

Oxfam warned that extreme wealth and income is not only unethical it is also economically inefficient, politically corrosive, socially divisive and environmentally destructive.

Annual income of richest 100 people enough to end global poverty four times over | Oxfam International

Stock Analysts Tell All! - Total Return - WSJ

So.....who can you trust in this world today?

Earlier this year, accounting professors Laurence Brown of Temple University, Andrew Call of the University of Georgia, Michael Clement of the University of Texas at Austin and Nathan Sharp of Texas A&M University surveyed 365 sell-side analysts and did 18 direct interviews, detailing how analysts do their work and view their roles. They made the results anonymous to ensure confidentiality.

Their study draws some striking conclusions:

Stock Analysts Tell All! - Total Return - WSJ

Earlier this year, accounting professors Laurence Brown of Temple University, Andrew Call of the University of Georgia, Michael Clement of the University of Texas at Austin and Nathan Sharp of Texas A&M University surveyed 365 sell-side analysts and did 18 direct interviews, detailing how analysts do their work and view their roles. They made the results anonymous to ensure confidentiality.

Their study draws some striking conclusions:

- Asked who was their most important group of clients, 81.5% of analysts picked “hedge funds.” Only 13.3% chose “retail brokerage clients.”

- Fewer than a quarter of the analysts said that the “accuracy and timeliness” of their earnings forecasts were very important to their compensation. Only 35% said that the profitability of their stock recommendations was crucial in determining how much they earned. Their “standing in analyst rankings or broker votes,” however – essentially how they score in media surveys, “broker votes” and other annual popularity contests among clients – was very important in shaping compensation for 67% of the analysts.

Stock Analysts Tell All! - Total Return - WSJ

Sunday, April 28, 2013

South Korea economic growth hits two-year high

South Korea's growth rate hit a two-year high in the first three months of the year, boosted by a rebound in construction, investment and exports. The economy grew by 0.9% in the January to March quarter from the previous three months, the central bank's estimates showed. The data is likely to help allay fears over the health of the Korean economy. Earlier this year, the government cut its growth forecast for the current year amid a slowdown in exports. However, the latest data showed a 3.2% quarter-on-quarter growth in exports during the period. That compares with a 1.2% drop in the previous quarter.

The South Korean won has risen by nearly 10% against the US dollar since May, making its exports more expensive to foreign buyers. Meanwhile, there has been a sharp decline in the Japanese yen, which has dipped almost 20% against the US dollar since November last year, triggered by an aggressive monetary policy stance by the new Japanese government.

There have been fears that because Japan and South Korea compete in similar markets, Korean goods may lose out as a result of the currency moves and that such developments may also hurt South Korea's overall growth. However, analysts said the latest data indicated that the moves had not had a significant affect on the sector. "Exports improved even though the yen was depreciating, suggesting that there hasn't been any major impact on growth yet," said Kong Dong-Pak, an analyst at Hanwha Securities.

| $1 buys | change | % |

|---|---|---|

| 1111.5000 | +

+0.16

| +

+0.01

|

As a result, policymakers have been taking measures to boost domestic consumption in an attempt to offset the decline in foreign sales and sustain growth. Last week, the government unveiled a 17.3tn won ($15.3bn; £9.2bn) stimulus plan. It said the funds would be used to help small and medium-sized exporters, create jobs, boost a stagnant property market and cover a shortfall in tax revenue. The move is expected to help boost annual growth by 0.3 percentage point this year and create 40,000 jobs. Analysts said that as the plan is implemented and starts to impact real growth, policymakers may revise their projections upwards. "Once the government's extra budget starts kicking in, it's possible that the Bank of Korea could raise its 2013 growth forecast come July," said Mr Kong of Hanwha Securities.

http://www.bbc.co.uk/news/business-22289514

While Wronged Homeowners Got 300 Apiece in Foreclosure Settlement, Consultants Who Helped Protect Banks Got 2 Billion | Matt Taibbi | Rolling Stone

From this piece:

The obscene greed-and-arrogance stories emanating from Wall Street are piling up so fast, it's getting hard to keep up. This one is from last week, but I missed it – it's about the foreclosure/robo-signing settlement that was concluded earlier this year. The upshot of this story is that in advance of that notorious settlement, the government ordered banks to hire "independent" consultants to examine their loan files to see just exactly how corrupt they were. Now it comes out that not only were these consultants not so independent, not only did they very likely skew the numbers seriously in favor of the banks, and not only were these few consultants paid over $2 billion (over 20 percent of the entire settlement amount) while the average homeowner only received $300 in the deal – in addition to all of that, it appears that federal regulators will not turn over the evidence of impropriety they discovered during these reviews to homeowners who may want to sue the banks. In other words, the government not only ordered the banks to hire consultants who may have gamed the foreclosure settlement in favor of the banks, but the regulators themselves are hiding the information from the public in order to shield the banks from further lawsuits.

Read more: http://www.rollingstone.com/politics/blogs/taibblog/while-wronged-homeowners-got-300-apiece-in-foreclosure-settlement-consultants-who-helped-protect-banks-got-2-billion-20130426#ixzz2RlmuKpqg

Follow us: @rollingstone on Twitter | RollingStone on Facebook

While Wronged Homeowners Got 300 Apiece in Foreclosure Settlement, Consultants Who Helped Protect Banks Got 2 Billion | Matt Taibbi | Rolling Stone

The obscene greed-and-arrogance stories emanating from Wall Street are piling up so fast, it's getting hard to keep up. This one is from last week, but I missed it – it's about the foreclosure/robo-signing settlement that was concluded earlier this year. The upshot of this story is that in advance of that notorious settlement, the government ordered banks to hire "independent" consultants to examine their loan files to see just exactly how corrupt they were. Now it comes out that not only were these consultants not so independent, not only did they very likely skew the numbers seriously in favor of the banks, and not only were these few consultants paid over $2 billion (over 20 percent of the entire settlement amount) while the average homeowner only received $300 in the deal – in addition to all of that, it appears that federal regulators will not turn over the evidence of impropriety they discovered during these reviews to homeowners who may want to sue the banks. In other words, the government not only ordered the banks to hire consultants who may have gamed the foreclosure settlement in favor of the banks, but the regulators themselves are hiding the information from the public in order to shield the banks from further lawsuits.

Read more: http://www.rollingstone.com/politics/blogs/taibblog/while-wronged-homeowners-got-300-apiece-in-foreclosure-settlement-consultants-who-helped-protect-banks-got-2-billion-20130426#ixzz2RlmuKpqg

Follow us: @rollingstone on Twitter | RollingStone on Facebook

While Wronged Homeowners Got 300 Apiece in Foreclosure Settlement, Consultants Who Helped Protect Banks Got 2 Billion | Matt Taibbi | Rolling Stone

Theory and reality

From an editorial comment in London's Evening Standard (link is here):

THE media concentration on the tiny movement in quarterly growth figures is intellectual nonsense — for one thing, the numbers remain prone to revision. Almost none of the slow growth is down to "austerity" because the volume of government consumption has increased way beyond official intentions, albeit through poor control rather than overt intent.

I suspect the three main causes of weak growth are Osborne's many misguided tax increases, particularly in 2010, weak demand in our European export markets and a sluggish growth of broad money and credit caused by over-zealous regulation. Demand from EU markets is weakening further and we can only hope for no more adverse shocks from the other two factors. However, that is up to the politicians. Prof David B Smith THE Chancellor's economic policies were never going to work since he has failed to address our hopelessly uncompetitive export prices — almost entirely an exchange rate problem.

Worse, on the evidence of Commons debates hardly anyone in politics seems much concerned about it.

Even at $1.50 to the pound, it still costs far more to manufacture almost anything in the UK compared with the Far East. To regain enough competitiveness to pay our way in the world we need an exchange rate of not much more than £1.00 = $1.00. Until we wake up to this we face years of pointless austerity, low growth, high unemployment, increasing inequality and relative national decline. Why are we allowing our economy to be run so badly? John Mills, JML Group NOWHERE are things worse than in the construction industry, which is at its lowest ebb since 1999. Construction is one of the most effective sectors in which to invest. The wide, varied and substantially UK-based supply chain means that every £1 spent delivers £2.84 in economic output. But there has been a real reluctance to invest. Promised spending has been continually deferred or, like HS2, is so far away as to have little or no impact on the present malaise.

We're told there's no money left and that we have to clear the public debt. But this is an increasingly untenable line to take. Government can borrow money more cheaply than it has ever been able to. High levels of public debt are nothing new — the national debt is at a lower level than it has been for most of the past century.

We need new and improved roads, schools, infrastructure, and most of all, housing. If we boost construction, it will help other sectors in turn and push overall growth up.

Chris Hallam, partner, Pinsent Masons Infrastructure Projects Group GEORGE Osborne claims the economy is now "healing". I must say, I hadn't noticed any evidence of this, but I'm sure it won't be long now — after all, it seems to have mastered playing dead. Julian Self Almost none of the slow growth is down to "austerity" because the volume of government consumption has increased way beyond official intentions Prof David B Smith

Access World News - Document Display

THE media concentration on the tiny movement in quarterly growth figures is intellectual nonsense — for one thing, the numbers remain prone to revision. Almost none of the slow growth is down to "austerity" because the volume of government consumption has increased way beyond official intentions, albeit through poor control rather than overt intent.

I suspect the three main causes of weak growth are Osborne's many misguided tax increases, particularly in 2010, weak demand in our European export markets and a sluggish growth of broad money and credit caused by over-zealous regulation. Demand from EU markets is weakening further and we can only hope for no more adverse shocks from the other two factors. However, that is up to the politicians. Prof David B Smith THE Chancellor's economic policies were never going to work since he has failed to address our hopelessly uncompetitive export prices — almost entirely an exchange rate problem.

Worse, on the evidence of Commons debates hardly anyone in politics seems much concerned about it.

Even at $1.50 to the pound, it still costs far more to manufacture almost anything in the UK compared with the Far East. To regain enough competitiveness to pay our way in the world we need an exchange rate of not much more than £1.00 = $1.00. Until we wake up to this we face years of pointless austerity, low growth, high unemployment, increasing inequality and relative national decline. Why are we allowing our economy to be run so badly? John Mills, JML Group NOWHERE are things worse than in the construction industry, which is at its lowest ebb since 1999. Construction is one of the most effective sectors in which to invest. The wide, varied and substantially UK-based supply chain means that every £1 spent delivers £2.84 in economic output. But there has been a real reluctance to invest. Promised spending has been continually deferred or, like HS2, is so far away as to have little or no impact on the present malaise.

We're told there's no money left and that we have to clear the public debt. But this is an increasingly untenable line to take. Government can borrow money more cheaply than it has ever been able to. High levels of public debt are nothing new — the national debt is at a lower level than it has been for most of the past century.

We need new and improved roads, schools, infrastructure, and most of all, housing. If we boost construction, it will help other sectors in turn and push overall growth up.

Chris Hallam, partner, Pinsent Masons Infrastructure Projects Group GEORGE Osborne claims the economy is now "healing". I must say, I hadn't noticed any evidence of this, but I'm sure it won't be long now — after all, it seems to have mastered playing dead. Julian Self Almost none of the slow growth is down to "austerity" because the volume of government consumption has increased way beyond official intentions Prof David B Smith

Access World News - Document Display

Commodity traders made higher profits than the banks

According to an investigative piece in the Financial Times

The world's top commodities traders have pocketed nearly $250bn over the last decade, making the individuals and families that control the largely privately-owned sector big beneficiaries of the rise of China and other emerging countries. The net income of the largest trading houses since 2003 surpasses that of the combination of mighty Wall Street banks Goldman Sachs, JPMorgan Chase and Morgan Stanley, or that of an industrial giant like General Electric. They made more money than Toyota, Volkswagen, Ford Motor, BMW and Renault combined. A review by the Financial Times of thousands of pages of companies' filings and non-public documents marks the first comprehensive account of the industry. The revelation of the traders' profitability will heighten calls for greater transparency from an industry that although central to the global economy is little understood and largely unregulated. The review casts light on an era of remarkable growth in the sector that began in 2000 - when it made just $2.1bn in profit - and massively expanded the trading groups' influence.

Profit margins are falling in the industry because of slowing growth in international economies and increased competition. Still.....

Despite the stalling of profit growth and the fall in return on equity, the industry remains hugely profitable. The heads of some of the top trading houses - including Ivan Glasenberg of Glencore, Richard Elman of Noble Group and Claude Dauphin of Trafigura - have became billionaires, while families such as the Cargills and MacMillans behind Cargill have seen their wealth rise enormously.

The review includes financial details of companies with different business models, from pure-play commodities trading houses to groups that, on top of trading, have also invested in production assets. The companies are Glencore, Vitol, Trafigura, Mercuria, Gunvor, Cargill, Bunge, Archer Daniel Midland, Louis Dreyfus, Wilmar, Noble, CHS, Mitsubishi, Mitsui, Itochu, Sumitomo, Marubeni, GrainCorp, Olam and Traxys.

But the review excludes the trading operations that are part of much larger oil, gas and utility groups - such as BP and Royal Dutch Shell of the UK, Total and EDF of France, Eon and RWE of Germany and Lukoil and Gazprom of Russia. Those groups often overshadow the trading houses in oil. Industry estimates put the net income of those trading operations last year at about $5bn, well below the peak of 2008-09 of more than $10bn, but the exact level is difficult to ascertain.

The review also excludes banks, because their focus is on derivatives, rather than physical trading. But the trend among banks, including Goldman Sachs, Morgan Stanley and JPMorgan, chimes with the overall trend. Bankers said total commodity revenues dropped in 2012 to about $8bn, down from a peak of $15bn in 2007.

See link here.

The world's top commodities traders have pocketed nearly $250bn over the last decade, making the individuals and families that control the largely privately-owned sector big beneficiaries of the rise of China and other emerging countries. The net income of the largest trading houses since 2003 surpasses that of the combination of mighty Wall Street banks Goldman Sachs, JPMorgan Chase and Morgan Stanley, or that of an industrial giant like General Electric. They made more money than Toyota, Volkswagen, Ford Motor, BMW and Renault combined. A review by the Financial Times of thousands of pages of companies' filings and non-public documents marks the first comprehensive account of the industry. The revelation of the traders' profitability will heighten calls for greater transparency from an industry that although central to the global economy is little understood and largely unregulated. The review casts light on an era of remarkable growth in the sector that began in 2000 - when it made just $2.1bn in profit - and massively expanded the trading groups' influence.

Profit margins are falling in the industry because of slowing growth in international economies and increased competition. Still.....

Despite the stalling of profit growth and the fall in return on equity, the industry remains hugely profitable. The heads of some of the top trading houses - including Ivan Glasenberg of Glencore, Richard Elman of Noble Group and Claude Dauphin of Trafigura - have became billionaires, while families such as the Cargills and MacMillans behind Cargill have seen their wealth rise enormously.

The review includes financial details of companies with different business models, from pure-play commodities trading houses to groups that, on top of trading, have also invested in production assets. The companies are Glencore, Vitol, Trafigura, Mercuria, Gunvor, Cargill, Bunge, Archer Daniel Midland, Louis Dreyfus, Wilmar, Noble, CHS, Mitsubishi, Mitsui, Itochu, Sumitomo, Marubeni, GrainCorp, Olam and Traxys.

But the review excludes the trading operations that are part of much larger oil, gas and utility groups - such as BP and Royal Dutch Shell of the UK, Total and EDF of France, Eon and RWE of Germany and Lukoil and Gazprom of Russia. Those groups often overshadow the trading houses in oil. Industry estimates put the net income of those trading operations last year at about $5bn, well below the peak of 2008-09 of more than $10bn, but the exact level is difficult to ascertain.

The review also excludes banks, because their focus is on derivatives, rather than physical trading. But the trend among banks, including Goldman Sachs, Morgan Stanley and JPMorgan, chimes with the overall trend. Bankers said total commodity revenues dropped in 2012 to about $8bn, down from a peak of $15bn in 2007.

See link here.

Saturday, April 27, 2013

Top 4 Reasons Obamacare Will Harm U.S. Competitiveness

http://www.forbes.com/sites/chrisconover/2012/10/25/top-4-reasons-obamacare-will-harm-us-american-competitiveness/

This article from Forbes gives their top four reasons that Obamacare will harm competition in the United States. Do you agree or disagree with any or all of these reasons? What would be some of the long-term consequences of harming competition? And what effect would this have on our economy's recovery?

This article from Forbes gives their top four reasons that Obamacare will harm competition in the United States. Do you agree or disagree with any or all of these reasons? What would be some of the long-term consequences of harming competition? And what effect would this have on our economy's recovery?

The Biggest Price-Fixing Scandal Ever but out of sight, out of mind

You may have heard of the Libor scandal, in which at least three – and perhaps as many as 16 – of the name-brand too-big-to-fail banks have been manipulating global interest rates, in the process messing around with the prices of upward of $500 trillion (that's trillion, with a "t") worth of financial instruments. When that sprawling con burst into public view last year, it was easily the biggest financial scandal in history – MIT professor Andrew Lo even said it "dwarfs by orders of magnitude any financial scam in the history of markets."

But now:

Word has leaked out that the London-based firm ICAP, the world's largest broker of interest-rate swaps, is being investigated by American authorities for behavior that sounds eerily reminiscent of the Libor mess. Regulators are looking into whether or not a small group of brokers at ICAP may have worked with up to 15 of the world's largest banks to manipulate ISDAfix, a benchmark number used around the world to calculate the prices of interest-rate swaps..Interest-rate swaps are a tool used by big cities, major corporations and sovereign governments to manage their debt, and the scale of their use is almost unimaginably massive. It's about a $379 trillion market, meaning that any manipulation would affect a pile of assets about 100 times the size of the United States federal budget.

But now:

Word has leaked out that the London-based firm ICAP, the world's largest broker of interest-rate swaps, is being investigated by American authorities for behavior that sounds eerily reminiscent of the Libor mess. Regulators are looking into whether or not a small group of brokers at ICAP may have worked with up to 15 of the world's largest banks to manipulate ISDAfix, a benchmark number used around the world to calculate the prices of interest-rate swaps..Interest-rate swaps are a tool used by big cities, major corporations and sovereign governments to manage their debt, and the scale of their use is almost unimaginably massive. It's about a $379 trillion market, meaning that any manipulation would affect a pile of assets about 100 times the size of the United States federal budget.

And inequality is not just a 1% vs 99% meme

THE median pay of American workers has stagnated in recent years, but that is not true for all workers. When adjusted for inflation, the wages of low-paid workers have declined. But the wages for better-paid workers have grown significantly more rapidly than inflation.

Wage Disparity Continues to Grow - NYTimes.com

Wage Disparity Continues to Grow - NYTimes.com

Bangladesh Rana Plaza Factory Collapse Retailer Response | Styleite

A couple of short videos:

http://www.youtube.com/watch?v=3MSL2WUGYuo

Bangladesh Rana Plaza Factory Collapse Retailer Response | Styleite

Outsourcing consequences.....

http://www.youtube.com/watch?v=3MSL2WUGYuo

Bangladesh Rana Plaza Factory Collapse Retailer Response | Styleite

Outsourcing consequences.....

The neoliberal assault on academia - Opinion - Al Jazeera English

The New York Times, Slate and Al Jazeera have recently drawn attention to the adjunctification of the professoriate in the US. Only 24 per cent of the academic workforce are now tenured or tenure-track.

Much of the coverage has focused on the sub-poverty wages of adjunct faculty, their lack of job security and the growing legions of unemployed and under-employed PhDs. Elsewhere, the focus has been on web-based learning and the massive open online courses (MOOCs), with some commentators celebrating and others lamenting their arrival. ..... As a dose of shock capitalism, the 2008 financial crisis accelerated processes already well underway. In successive waves, the crisis has hit each pillar of the American university system. The initial stock market crash blasted the endowments of the prestige private universities. Before long, neoliberal ideologues and their disastrous austerity policies undermined state and eventually federal funding for universities and their research.

Tuition soared and students turned even more to debt financing. Now that bubble is bursting and hitting all the institutions of higher education that depend on tuition. Students are increasingly unwilling to take on massive debt for jobs they have little confidence of getting.

The neoliberal assault on academia - Opinion - Al Jazeera English

Friday, April 26, 2013

Study shows 45% of Bitcoin exchanges end up failing

http://bgr.com/2013/04/26/bitcoin-exchange-failure-rate-45-percent-467146/

45% of Bitcoin exchanges end up shutting their virtual doors while leaving their users’ money in limbo. However, this doesn’t mean that the Bitcoin exchanges that have survived so far are safe havens, since the study also shows that they’re under constant assault from cybercriminals who are working around the clock to hack users’ transactions.

Viral video shows how wealth is really distributed

Watch the short video--it is fascinating.

Viral video shows how wealth is really distributed - Economy

On a similar note: isn't it fascinating that the 6 Walmart heirs have as much wealth as the lowest 42% of the American income distribution? Here is a short article on the Walmart family wealth.

As Josh Bivens of the Economic Policy Insitute points out, the six Walmart heirs now have more wealth than the bottom 42 percent of Americans combined, up from 30 percent in 2007. Between 2007 and 2010, the collective wealth of the six richest Waltons rose from $73 billion to $90 billion, while the wealth of the average American declined from $126,000 to $77,000 (13 million Americans have negative net worth). Here's a chart of how many average Americans it has taken over time to equal the wealth of the Waltons: (see here for link)

Viral video shows how wealth is really distributed - Economy

On a similar note: isn't it fascinating that the 6 Walmart heirs have as much wealth as the lowest 42% of the American income distribution? Here is a short article on the Walmart family wealth.

As Josh Bivens of the Economic Policy Insitute points out, the six Walmart heirs now have more wealth than the bottom 42 percent of Americans combined, up from 30 percent in 2007. Between 2007 and 2010, the collective wealth of the six richest Waltons rose from $73 billion to $90 billion, while the wealth of the average American declined from $126,000 to $77,000 (13 million Americans have negative net worth). Here's a chart of how many average Americans it has taken over time to equal the wealth of the Waltons: (see here for link)

Thursday, April 25, 2013

The Dollar Vigilante

So you'll probably recognize the guy in this video, Jeff Berwick, from the Bitcoin interview we watched in class. He writes this economically focused financial newsletter called The Dollar Vigilante.

http://www.youtube.com/user/TheDollarVigilante

Essentially, he thinks that the US economy is going to collapse in the next few years, followed by many other major players in the global economy. If you skip to about 2:30 he makes a bold claim: "government can never help anything." What??

Another highlight at 8:09. Listen to what he has to say about Canada.

Do you agree or disagree with Berwick's somewhat controversial views of the US economy and government? Did his arguments convince you that our economy is quickly approaching a collapse? Or do you think he's a huge weirdo that doesn't know what hes talking about?

http://www.youtube.com/user/TheDollarVigilante

Essentially, he thinks that the US economy is going to collapse in the next few years, followed by many other major players in the global economy. If you skip to about 2:30 he makes a bold claim: "government can never help anything." What??

Another highlight at 8:09. Listen to what he has to say about Canada.

Do you agree or disagree with Berwick's somewhat controversial views of the US economy and government? Did his arguments convince you that our economy is quickly approaching a collapse? Or do you think he's a huge weirdo that doesn't know what hes talking about?

Democracy in Europe

How can the EU stick together when lack of trust has grown to record levels?

Crisis for Europe as trust hits record low

Wednesday, April 24, 2013

The Truth About Where Your Donated Clothes End Up

http://abcnews.go.com/WNT/story?id=2743456#.UXcl-CuG2nY

Last night we discussed a few organizations committed to helping people in other countries. Tom's, for example, donates a pair of shoes to someone in need for every pair purchased here in the US. Another that was mentioned by Ryan, was an organization that distributes empty boxes with prepaid postage that a person could fill with clothes they wish to donate, then track their donation to wherever it may end up. This article shows the darker side of some charitable institutions, tracking the path your donated clothes actually follow.

After learning the truth, do you agree with what organizations such as Goodwill or the Salvation Army are doing? Does the economic efficiency of such transactions outweigh the questionable morality / sleaziness / deception?

Jared shall not be permitted to comment on this post.

Last night we discussed a few organizations committed to helping people in other countries. Tom's, for example, donates a pair of shoes to someone in need for every pair purchased here in the US. Another that was mentioned by Ryan, was an organization that distributes empty boxes with prepaid postage that a person could fill with clothes they wish to donate, then track their donation to wherever it may end up. This article shows the darker side of some charitable institutions, tracking the path your donated clothes actually follow.

After learning the truth, do you agree with what organizations such as Goodwill or the Salvation Army are doing? Does the economic efficiency of such transactions outweigh the questionable morality / sleaziness / deception?

Jared shall not be permitted to comment on this post.

Downward mobility in US education

From the BBC:

The idea of going to college - and the expectation that the next generation will be better educated and more prosperous than its predecessor - has been hardwired into the ambitions of the middle classes in the United States...Andreas Schleicher, special adviser on education at the Organisation for Economic Co-operation and Development (OECD), says the US is now the only major economy in the world where the younger generation is not going to be better educated than the older. "It's something of great significance because much of today's economic power of the United States rests on a very high degree of adult skills - and that is now at risk," says Mr Schleicher.....The annual OECD education statistics show that only about one in five young adults in the US reaches a higher level of education than their parents - among the lowest rates of upward mobility in the developed world.

Read the rest at:

BBC News - Downward mobility haunts US education

The idea of going to college - and the expectation that the next generation will be better educated and more prosperous than its predecessor - has been hardwired into the ambitions of the middle classes in the United States...Andreas Schleicher, special adviser on education at the Organisation for Economic Co-operation and Development (OECD), says the US is now the only major economy in the world where the younger generation is not going to be better educated than the older. "It's something of great significance because much of today's economic power of the United States rests on a very high degree of adult skills - and that is now at risk," says Mr Schleicher.....The annual OECD education statistics show that only about one in five young adults in the US reaches a higher level of education than their parents - among the lowest rates of upward mobility in the developed world.

Read the rest at:

BBC News - Downward mobility haunts US education

Stephen Colbert On Thomas Herndon And Reinhart And Rogoff - Business Insider

If GDP=C+I+G+X-M, cutting G will cut GDP by definition. So why austerity? Stephen Colbert weighs in on the matter.

Stephen Colbert On Thomas Herndon And Reinhart And Rogoff - Business Insider

Stephen Colbert On Thomas Herndon And Reinhart And Rogoff - Business Insider

Tuesday, April 23, 2013

Checking in on Cyprus

In the article, Cyprus to Open Casinos to Restart Economy, elaborates on exactly that.

In hopes to boost the growth in economy of Cyprus, they have decided to open some casinos. Their hopes are that by boosting the tourism sector, they will be able to offer jobs to the jobless and bring in outsiders to stimulate the economy.

Some other plans are as follows:

Giving businesses tax breaks for hiring new workers, setting up solar energy parks, young people will be granted state and church-owned land for cultivation, and those having homes or businesses seized because they're unable to pay off loans would be able to stay on as renters.

How do you think this will transform Cyprus in the future? Will this put Cyprus on the road to recovery? What else, if anything, do you think Cyprus could/should do?

In hopes to boost the growth in economy of Cyprus, they have decided to open some casinos. Their hopes are that by boosting the tourism sector, they will be able to offer jobs to the jobless and bring in outsiders to stimulate the economy.

Some other plans are as follows:

Giving businesses tax breaks for hiring new workers, setting up solar energy parks, young people will be granted state and church-owned land for cultivation, and those having homes or businesses seized because they're unable to pay off loans would be able to stay on as renters.

How do you think this will transform Cyprus in the future? Will this put Cyprus on the road to recovery? What else, if anything, do you think Cyprus could/should do?

A little history behind modern macroeconomic theory

Prior to the crisis, macroeconomists believed that large financial crashes – the type that could cause a Great Depression – were all but impossible in a modern economy guided by brilliant economists. Because of this, standard theoretical models focused on other questions.

I am not convinced that these “Dynamic Stochastic General Equilibrium” models will, in the end, be capable of being pushed as far as we need to go. But there is progress and we are finding that many of the results in the older models about liquidity traps, government spending multipliers, debt, inflation, and so on carry through to the modern models. Second, there are efforts to challenge the mainstream with competing models from groups such as the Institute for New Economic Thinking, and there is far more willingness than I expected among young researchers to look into alternatives such as network and agent-based theoretical models. This will help to push the research forward.

But when it comes to the empirical methods we use to sort between competing theoretical models, it’s hard to be as optimistic. Empirical research in macroeconomics is plagued by the uncertainty that comes with small data sets and the use of historical rather than experimental data. In addition, as the Reinhart-Rogoff episode makes clear, our devotion to the important tasks of validating and replicating empirical results leaves a lot to be desired. Even worse, too many minds in the profession cannot be changed even when the empirical evidence is relatively clear.

This last point fascinates me. There is no clear reason to undertake extreme austerity measures right now. Yes, government debt is too high but there is no theoretical reason to cut government spending right now. Yet, the politics say it is necessary. Why?

Why Politics and Economics Are a Toxic Cocktail

I am not convinced that these “Dynamic Stochastic General Equilibrium” models will, in the end, be capable of being pushed as far as we need to go. But there is progress and we are finding that many of the results in the older models about liquidity traps, government spending multipliers, debt, inflation, and so on carry through to the modern models. Second, there are efforts to challenge the mainstream with competing models from groups such as the Institute for New Economic Thinking, and there is far more willingness than I expected among young researchers to look into alternatives such as network and agent-based theoretical models. This will help to push the research forward.

But when it comes to the empirical methods we use to sort between competing theoretical models, it’s hard to be as optimistic. Empirical research in macroeconomics is plagued by the uncertainty that comes with small data sets and the use of historical rather than experimental data. In addition, as the Reinhart-Rogoff episode makes clear, our devotion to the important tasks of validating and replicating empirical results leaves a lot to be desired. Even worse, too many minds in the profession cannot be changed even when the empirical evidence is relatively clear.

This last point fascinates me. There is no clear reason to undertake extreme austerity measures right now. Yes, government debt is too high but there is no theoretical reason to cut government spending right now. Yet, the politics say it is necessary. Why?

Why Politics and Economics Are a Toxic Cocktail

Copper, landslides, and the real economy

Inside a mile-deep open-pit copper mine after a catastrophic landslide - Boing Boing

An unimaginably large landslide occurred in the world's largest copper mine, shutting it down indefinitely:

In short, the events of a few seconds on an April evening in 2013 are beginning to move through the economy, and will reverberate for at least a decade. And who will feel the vibrations, if they know what to feel for? Everyone who uses electricity, telecommunicates, gets their water from a tap, or eats food raised by Big Agriculture. Wires, pipes, and fertilizer: that’s what copper is used for.

I think we get too accustomed to abstract things, like changes in the federal interest rate or the pace of Chinese growth, shifting global markets. It’s good to be reminded that sometimes it's still the earth itself that shakes the world.

An unimaginably large landslide occurred in the world's largest copper mine, shutting it down indefinitely:

In short, the events of a few seconds on an April evening in 2013 are beginning to move through the economy, and will reverberate for at least a decade. And who will feel the vibrations, if they know what to feel for? Everyone who uses electricity, telecommunicates, gets their water from a tap, or eats food raised by Big Agriculture. Wires, pipes, and fertilizer: that’s what copper is used for.

I think we get too accustomed to abstract things, like changes in the federal interest rate or the pace of Chinese growth, shifting global markets. It’s good to be reminded that sometimes it's still the earth itself that shakes the world.

Monday, April 22, 2013

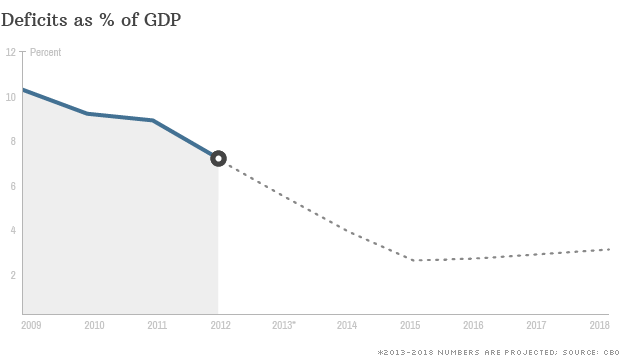

Deficits are falling. For now

A piece of the article, Deficits are falling. For now , says this..

A piece of the article, Deficits are falling. For now , says this.."There are several reasons for the downward trend. The economy is on the mend. Incoming federal revenue has risen from 60-year lows and will soon top its historical average for much of the next decade. Spending, meanwhile, has come down from 60-year highs.

And, of course, projections have improved because Congress and President Obama have signed off on $4 trillion of deficit reduction that is set to unfold over the next decade. That assumes the roughly $1 trillion in forced budget cuts that went into effect last month are kept on the books or replaced with something comparable, as Obama has proposed."

Do you think that we will be able to stay on the track estimated?

Do you think we need to be as worried of the deficit since congress and Obama signed off on the reduction plan?

How do you think this reduction and the budget cuts will effect the normal American?

More on the trade agreement

Six hundred US corporate advisors have negotiated and had input into the TPP, and the proposed draft text has not been made available to the public, the press or policymakers. The level of secrecy surrounding the agreements is unparalleled – paramilitary teams scatter outside the premise of each round of discussions while helicopters loom overhead – media outlets impose a near-total blackout of reportage on the subject and US Senator Ron Wyden, the Chair of the Congressional Committee with jurisdiction over TPP, was denied access to the negotiation texts. “The majority of Congress is being kept in the dark as to the substance of the TPP negotiations, while representatives of U.S. corporations — like Halliburton, Chevron, PhaRMA, Comcast and the Motion Picture Association of America — are being consulted and made privy to details of the agreement,” said Wyden, in a floor statement to Congress...... the TPP stifles innovation by requiring internet service providers to police user-activity and treat small-scale individual downloads as large-scale for-profit violators. Most predictably, it would rollback regulation of finance capital predators on Wall Street by prohibiting bans on risky financial services and preventing signatory nations from exercising the ability to independently pursue monetary policy and issue capital controls – signatories must permit the free flow of derivatives, currency speculation and other manipulative financial instruments. The US-led partnership – which seeks to impose ‘Shock and Awe’ Globalization – aims to abolish the accountability of multinational corporations to the governments of countries with which they trade by making signatory governments accountable to corporations for costs imposed by national laws and regulations, including health, safety and environmental regulations.....Due to the unconstitutional nature of the TPP, members of Congress would likely object to many of its stipulations – naturally, the Obama administration is employing its executive muscle to restrict congressional authority by operating under “fast-track authority,” a trade provision that requires Congress to review an FTA under limited debate in an accelerated time frame subject to a yes-or-no vote so as to assure foreign partners that the FTA, once signed, will not be changed during the legislative process. No formal steps have been taken to consult Congress as the agreement continues to be negotiated, and Obama looks set to subtly ram the treaty into law. Such is the toxic nature of US policies that seek to bring in disaster-capitalism on a global scale, while keeping those whose lives will be most affected by deal completely in the dark.

The Trans-Pacific Partnership (TPP), An Oppressive US-Led Free Trade Agreement, A Corporate Power-Tool of the 1% | Global Research

The Trans-Pacific Partnership (TPP), An Oppressive US-Led Free Trade Agreement, A Corporate Power-Tool of the 1% | Global Research

Why The Reinhart-Rogoff Excel Debacle Could Be Devastating For The Austerity Movement - Business Insider

So....the intellectual justification for austerity no longer exists. Go to:

Why The Reinhart-Rogoff Excel Debacle Could Be Devastating For The Austerity Movement - Business Insider

And if you think the federal government is out of control, take a look at these graphs: (see link here)

Why The Reinhart-Rogoff Excel Debacle Could Be Devastating For The Austerity Movement - Business Insider

And if you think the federal government is out of control, take a look at these graphs: (see link here)

US hails Japan participation in trans-Pacific trade agreement

So what is this trade agreement?

With the entry of Japan into the free-trade talks the pact would cover nearly 40 percent of the global economy, making it the biggest free-trade agreement in the world. The bloc is aimed creating a tariff-free zone with a market of around US$25 trillion covering some 800 million people. Japan joins Australia, Brunei, Chile, Canada, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States and Vietnam in TPP negotiations. (see link here)

The problem with the trade agreement is that Congress and the public are not able to see the documents used in negotiations. The negotiations are being handled outside of Congress. One chapter on investments was leaked to the press.

The leaked draft of the Trans-Pacific Partnership (TPP) investment chapter has been published online by Citizens Trade Campaign, the same coalition that first published TPP proposals from the United States on intellectual property, regulatory coherence and drug formularies in late 2011. Draft texts are said to exist for some 26 separate chapters, none of which have ever been officially released by trade negotiators for public review. Americans deserve the right to know what U.S. negotiators are proposing in our names,” said Arthur Stamoulis, executive director of Citizens Trade Campaign. ”In the absence of transparency on the part of our government, we have a responsibility to share what information we receive about the TPP with the public.” The new texts reveal that TPP negotiators are considering a dispute resolution process that would grant transnational corporations special authority to challenge countries’ laws, regulations and court decisions in international tribunals that circumvent domestic judicial systems.

(see here for link)

With the entry of Japan into the free-trade talks the pact would cover nearly 40 percent of the global economy, making it the biggest free-trade agreement in the world. The bloc is aimed creating a tariff-free zone with a market of around US$25 trillion covering some 800 million people. Japan joins Australia, Brunei, Chile, Canada, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States and Vietnam in TPP negotiations. (see link here)

The problem with the trade agreement is that Congress and the public are not able to see the documents used in negotiations. The negotiations are being handled outside of Congress. One chapter on investments was leaked to the press.

The leaked draft of the Trans-Pacific Partnership (TPP) investment chapter has been published online by Citizens Trade Campaign, the same coalition that first published TPP proposals from the United States on intellectual property, regulatory coherence and drug formularies in late 2011. Draft texts are said to exist for some 26 separate chapters, none of which have ever been officially released by trade negotiators for public review. Americans deserve the right to know what U.S. negotiators are proposing in our names,” said Arthur Stamoulis, executive director of Citizens Trade Campaign. ”In the absence of transparency on the part of our government, we have a responsibility to share what information we receive about the TPP with the public.” The new texts reveal that TPP negotiators are considering a dispute resolution process that would grant transnational corporations special authority to challenge countries’ laws, regulations and court decisions in international tribunals that circumvent domestic judicial systems.

(see here for link)

Friday, April 19, 2013

5 signs of an investing Bubble

Here is another video and article about the bitcoin and its bubble.

1) Valuations deviate significantly from a long-term historical average

Luna points to the housing bubble as an example of assets with established valuation metrics getting woefully distorted. Decades of conventional wisdom suggests the "right" amount to spend on a house is about 3x annual income. When people started quiting their real jobs and buying 2 or 3 houses on margin, it was a sign things weren't going to end well for houseflippers.

Related: Is it Better to Rent or Buy Your Home?

2) Analysts begin making outlandish predictions as assets hit new highs

Dow 36,000. Apple (AAPL) hitting a trillion dollar market cap. Bitcoin becoming the world's global standard for currency. All are examples of the kind of predictions that get made at the top of an investing cycle, not the bottom.

The prognostications seem like lunacy in retrospect, but were conventional wisdom, if only for a moment. Remember: Splashy predictions get headlines but slow and steady wins the race for investors.

"When you start hearing those things after a big a move in a stock, whatever asset class it may be, usually is a tell-tale sign to head for the exits," says Luna.

3) Everyone and their mother is the new expert on investing in this asset class

Luna notes that "every waiter" seemed to quit their job to become a day-trader in 1999 or a realtor in 2005. When making money seems so easy that amateurs start quitting their day jobs to make real money competing against professionals, it's a good clue that a bubble is forming.

4) People believe that “this time is different”

This time is never really different.

5) Political manipulation, unsustainable asset catalysts

It's no coincidence bitcoin's popularity came at a the same time the meltdown in Cyprus was making fools of the world's Central Banks. When political forces start impacting one group of assets, bubbles pop up to fill whatever voids are left behind. Gold became a bubble because currency was manipulated. Bitcoins popped up because Cyprus made it look as though no form of "real" currency would be safe.

The odds never favor a political or policy-driven rush into assets being sustainable. Eventually the free market wins out, and when it does, bubbles violently deflate, leaving financial disaster in their wake. That doesn't mean you have to be one of the victims. Learn from history and recognize bubbles in real time.

What are your thoughts?

1) Valuations deviate significantly from a long-term historical average

Luna points to the housing bubble as an example of assets with established valuation metrics getting woefully distorted. Decades of conventional wisdom suggests the "right" amount to spend on a house is about 3x annual income. When people started quiting their real jobs and buying 2 or 3 houses on margin, it was a sign things weren't going to end well for houseflippers.

Related: Is it Better to Rent or Buy Your Home?

2) Analysts begin making outlandish predictions as assets hit new highs

Dow 36,000. Apple (AAPL) hitting a trillion dollar market cap. Bitcoin becoming the world's global standard for currency. All are examples of the kind of predictions that get made at the top of an investing cycle, not the bottom.

The prognostications seem like lunacy in retrospect, but were conventional wisdom, if only for a moment. Remember: Splashy predictions get headlines but slow and steady wins the race for investors.

"When you start hearing those things after a big a move in a stock, whatever asset class it may be, usually is a tell-tale sign to head for the exits," says Luna.

3) Everyone and their mother is the new expert on investing in this asset class

Luna notes that "every waiter" seemed to quit their job to become a day-trader in 1999 or a realtor in 2005. When making money seems so easy that amateurs start quitting their day jobs to make real money competing against professionals, it's a good clue that a bubble is forming.

4) People believe that “this time is different”

This time is never really different.

5) Political manipulation, unsustainable asset catalysts

It's no coincidence bitcoin's popularity came at a the same time the meltdown in Cyprus was making fools of the world's Central Banks. When political forces start impacting one group of assets, bubbles pop up to fill whatever voids are left behind. Gold became a bubble because currency was manipulated. Bitcoins popped up because Cyprus made it look as though no form of "real" currency would be safe.

The odds never favor a political or policy-driven rush into assets being sustainable. Eventually the free market wins out, and when it does, bubbles violently deflate, leaving financial disaster in their wake. That doesn't mean you have to be one of the victims. Learn from history and recognize bubbles in real time.

What are your thoughts?

Thursday, April 18, 2013

Does The Crash In Precious Metals Signal The Beginning of Another Financial Crisis?

In this Article Panos is saying that due to the crash in precious metals over the past few day, he fears that we could potentially see a financial crisis worse than that of 2008.

Precious metals crashed on Monday, gold falling 9% and silver falling 12%

What then occurred was this in the Major Equity Index

What do you make of the correlation between the fall in precious metals and the fall in the index?

Do you think that this could lead us into yet another financial crisis or is this just a phase?

One way Panos says we can avoid this potential crisis is to "use financial derivatives rather than traditional asset diversification." Do you think it's wise for people to begin to do this? Do you have any suggestions?

These related articles,

Gold Falls 5%, Silver 8% Monday Morning As Precious Metals Crash Continues

Gold Price Slumps 9%, Back Under $1,400

give some facts about the decline in precious metals over the past few days.

Precious metals crashed on Monday, gold falling 9% and silver falling 12%

What then occurred was this in the Major Equity Index

| Index | One-Day Performance (%) |

| SPDR S&P 500 Trust (NYSE:SPY) | -2.32 |

| Powershares QQQ Trust(NASDAQ:QQQ) | -1.97 |

| SPDR Dow Jones Industrial Average (NYSE:DIA) | -1.76 |

What do you make of the correlation between the fall in precious metals and the fall in the index?

Do you think that this could lead us into yet another financial crisis or is this just a phase?

One way Panos says we can avoid this potential crisis is to "use financial derivatives rather than traditional asset diversification." Do you think it's wise for people to begin to do this? Do you have any suggestions?

These related articles,

Gold Falls 5%, Silver 8% Monday Morning As Precious Metals Crash Continues

Gold Price Slumps 9%, Back Under $1,400

give some facts about the decline in precious metals over the past few days.

I wish he weren't a credible commentartor on world economic events

Ambrose Evans Pitcher writes about the international economy for the Telegraph. He wrote a fairly dismal piece recently about the plunge in gold prices and what it might mean. Read it here. Basically, the world financial system is not fixed and its problems are now rebounding big time into the real economies of all of the industrialized/industrializing countries.

A few bits:

You have to be careful reading too much into commodities, distorted by China. The time-honoured cycle is a surge of investment that comes on stream at once with a lag. America's shale drive has turned the gas market upside down, diverting liquefied natural gas to Europe and Asia. Copper output in Chile rose 7pc last year. The crash in the Baltic Dry Index for shipping rates is partly a tale of too many ships.Yet excess supply does not explain the collapse in gold over the past week. Cyprus may have been an incidental trigger. If the EU-IMF Troika is determined to strong-arm the Cypriots into selling most of their pint-sized holding of 14 tonnes, it may do the same to Portugal when the time comes, and then you are talking about the world's 14th biggest holding of 382 tonnes.Bank of America says the gold crash since Friday has already discounted sales of the entire Cypriot, Portuguese and Greek gold reserves combined. "As we believe additional gold selling in the European periphery is highly unlikely, we find it hard to fully justify the sell-off," it said.

He uses this term to describe the world:

The world is still in a contained depression.

A few bits:

You have to be careful reading too much into commodities, distorted by China. The time-honoured cycle is a surge of investment that comes on stream at once with a lag. America's shale drive has turned the gas market upside down, diverting liquefied natural gas to Europe and Asia. Copper output in Chile rose 7pc last year. The crash in the Baltic Dry Index for shipping rates is partly a tale of too many ships.Yet excess supply does not explain the collapse in gold over the past week. Cyprus may have been an incidental trigger. If the EU-IMF Troika is determined to strong-arm the Cypriots into selling most of their pint-sized holding of 14 tonnes, it may do the same to Portugal when the time comes, and then you are talking about the world's 14th biggest holding of 382 tonnes.Bank of America says the gold crash since Friday has already discounted sales of the entire Cypriot, Portuguese and Greek gold reserves combined. "As we believe additional gold selling in the European periphery is highly unlikely, we find it hard to fully justify the sell-off," it said.

He uses this term to describe the world:

The world is still in a contained depression.

Wednesday, April 17, 2013

Banks might be TBTF but they aren' large enough to help Apple go private

Shareholders are looking for dividends all over the place....the big institutional holders aren't interested in retained earnings and long term strategies. So many companies think about going private so they don't have to deal with shareholders.

So here is the problem:

Taking Apple private: Makes sense but nobody has the money.

So here is the problem:

After today's share price decline Apple's market capitalization is $378.25 billion. Figure a very large aquisition premium of 50% and say you'd need a $567.38 billion loan to take the company private. Junk bond yields hit 5.5 percent this wake, meaning the company would need to generate $31 billion a year in nominal earnings to make the interest payments on the loan. Apple's Earnings Before Interest Taxes Depreciation and Amortization was $59 billion last year—more than enough to make the payments. So if Apple's managers are confident in the company's ability to maintain its 2012 level of earnings into the future they'd be way better off under a management buyout that took the company private than they are as employees of disgruntled shareholders. The problem here is that in inflation-adjusted terms the largest leveraged buyout in history was KKR's $55.38 billion aquisition of RJR Nabisco back in 1989 (that was $31.1 billion 1989 dollars). Could Apple tap its ~$140 billion in cash reserves to cut down on its borrowing needs and make the scenario more realistic? It sure could. But the problem is that a $512 billion loan isn't really any more realistic than a $567.38 billion loan. It's just way too much money. They say some banks are too big to fail, but Apple is too big to buy.

Go to the link below for the rest of the story.

Go to the link below for the rest of the story.

Taking Apple private: Makes sense but nobody has the money.

6 Ways the Financial Crisis Changed How We Invest

This article tells us how most individuals changed their investment strategy after the financial crisis. The main points are as follows:

1. People are now very pessimistic when looking towards the future.

2. Investors have learned that they will need to count only on themselves to prepare for retirement.

3. Since the financial crisis people are beginning to save more, putting more of their money into workplace savings plans and so on.

4. Creating emergency funds to protect them from job loss and so on.

5. People are now chipping away at their debt, realizing that if they miss or are late with a payment, even higher balances can occur.

6. Making more thoughtful investment choices. People are now searching for information about their investments.

"When the stock market took a hit, people stopped looking at their statements," says Hevert. "People aren't afraid to look anymore, and not only are they not afraid to look, but they're not afraid to talk about it."

Do you think that investors that are doing all of these will be safe in the future if something were to happen again? What else could investors do to protect themselves? Do you think this change in how we invest will last?

1. People are now very pessimistic when looking towards the future.

2. Investors have learned that they will need to count only on themselves to prepare for retirement.

3. Since the financial crisis people are beginning to save more, putting more of their money into workplace savings plans and so on.

4. Creating emergency funds to protect them from job loss and so on.

5. People are now chipping away at their debt, realizing that if they miss or are late with a payment, even higher balances can occur.

6. Making more thoughtful investment choices. People are now searching for information about their investments.

"When the stock market took a hit, people stopped looking at their statements," says Hevert. "People aren't afraid to look anymore, and not only are they not afraid to look, but they're not afraid to talk about it."

Do you think that investors that are doing all of these will be safe in the future if something were to happen again? What else could investors do to protect themselves? Do you think this change in how we invest will last?

Democracy in action????

Click on the link to see the donors and spending by the SuperPacs, the groups that many think are most significant in today's elections in the US.

PAC Track

PAC Track

Elementary misuse of spreadsheet data leaves millions unemployed | Bill Mitchell – billy blog

The blogosphere this morning is all over two researchers, Rogoff and Reinhart, who committed a spreadsheet error (read this as: messed up their excel file of data) and published based on the file. This then led to policy recommendations that are based on faulty findings. R&R said that the tipping point for a country in terms of debt was a 90% ratio of debt to GDP according to their spreadsheet of historic information. If a debt load grew more than that, the country imploded. When all the data is included in the spreadsheet, the negative ratio becomes positive.

Earlier this year, the IMF researchers admitted that their estimates of low Keynesian multipliers (1% or less) for fiscal stimulus (changes in G essentially) were wrong. Multipliers were 1.5% or more.

Elementary misuse of spreadsheet data leaves millions unemployed | Bill Mitchell – billy blog

Earlier this year, the IMF researchers admitted that their estimates of low Keynesian multipliers (1% or less) for fiscal stimulus (changes in G essentially) were wrong. Multipliers were 1.5% or more.

Elementary misuse of spreadsheet data leaves millions unemployed | Bill Mitchell – billy blog

Tuesday, April 16, 2013

New argument over high debt and GDP outcome

This is an article by the NY Times discussing whether or not a research paper over countries with high debt and GDP output were calculated correctly. From this new point of view over the statistical analysis there has been a great debate started over the policies that were put in place over the original research paper.

Flaws are cited

After reading the article, do you think this could be true?

Does it concern you the theory was followed so intently after this research paper was published before many had proven what they found?

With your knowledge of debt and risk, would you consider countries with a high debt to be a place where there would be no GDP growth to begin with?

Flaws are cited

After reading the article, do you think this could be true?

Does it concern you the theory was followed so intently after this research paper was published before many had proven what they found?

With your knowledge of debt and risk, would you consider countries with a high debt to be a place where there would be no GDP growth to begin with?

The dream and the reality

Salon has a good piece on the foreclosure settlement and the mess that it has caused. Basically, the banks got a great deal when they only had to pay $3.6 billion in damages for fraud.

Announcing that 14 mortgage servicers committed “violations of applicable state and federal law,” OCC would allow 4.2 million homeowners in foreclosure in 2009 and 2010 to petition for an “independent” review, and would mandate specific restitution for any foreclosure found to be improper. The real goal was to find as few irregularities as possible, to “prove” that the problem was contained to a few isolated cases of sloppy paperwork, and to undermine the other state and federal regulators’ investigations. It was the perfect plan, if your idea of a good plan is to downplay bank malfeasance and subvert justice. This plan began to take water from the moment it began. The Independent Foreclosure Reviews weren’t independent: OCC and the Fed, in their infinite wisdom, decided to let the banks hire and pay for their own third-party reviewers. The predictable consequences included a windfall for the bank consultants hired for the job – they made a combined $2 billion off the reviews – and numerous cases of reviewers deliberately minimizing evidence of borrower harm. Lax and often confusing oversight by OCC and the Fed, documented in a recent Government Accountability Office report, further turned the reviews into a catastrophe.

You can read the rest of the story at the link below. What it helps us to do is to understand that housing finance is still broken in this country.

The Fed messed with the wrong senator - Salon.com

Announcing that 14 mortgage servicers committed “violations of applicable state and federal law,” OCC would allow 4.2 million homeowners in foreclosure in 2009 and 2010 to petition for an “independent” review, and would mandate specific restitution for any foreclosure found to be improper. The real goal was to find as few irregularities as possible, to “prove” that the problem was contained to a few isolated cases of sloppy paperwork, and to undermine the other state and federal regulators’ investigations. It was the perfect plan, if your idea of a good plan is to downplay bank malfeasance and subvert justice. This plan began to take water from the moment it began. The Independent Foreclosure Reviews weren’t independent: OCC and the Fed, in their infinite wisdom, decided to let the banks hire and pay for their own third-party reviewers. The predictable consequences included a windfall for the bank consultants hired for the job – they made a combined $2 billion off the reviews – and numerous cases of reviewers deliberately minimizing evidence of borrower harm. Lax and often confusing oversight by OCC and the Fed, documented in a recent Government Accountability Office report, further turned the reviews into a catastrophe.

You can read the rest of the story at the link below. What it helps us to do is to understand that housing finance is still broken in this country.

The Fed messed with the wrong senator - Salon.com

Monday, April 15, 2013

VIDEO "Konczal: Dodd-Frank Reforms Get Roughed Up in Court"

Mike Konczal, fellow at the Roosevelt Institute and contributor to Bloomberg View, talks with Bloomberg Law’s Lee Pacchia about how the implementation of the financial reform laws in Dodd-Frank have been hampered by a series of adverse court decisions. Konczal contends that these decisions are not only a setback for proponents of reforming the financial industry, but also have a chilling effect on future efforts by regulators and lawmakers. At the same time, however, Konczal feels that these courthouse victories could end up harming the finance industry. “If it looks like the law is unable to do what it needs to you will see reformers come back with much harsher provisions…that the banks successful avoided the first time around,” he says.

Video here:

http://www.ritholtz.com/blog/2013/04/konczal-dodd-frank-reforms-get-roughed-up-in-court/

America’s Inefficient Health Care System from the Big Picture

Click on the link below to see the infographic. Think about the interplay of regulation, big business, government, and myth.

America’s Inefficient Health Care System | The Big Picture

America’s Inefficient Health Care System | The Big Picture

Sunday, April 14, 2013

When the Zombies Attack, You’ll Need Your Gun

http://www.bloomberg.com/news/2013-04-11/when-the-zombies-attack-you-ll-need-your-gun.html

Zombies are everywhere these days. In June, Brad Pitt will star in the film version of Max Brooks’s best-selling novel “World War Z.” The Westerosi of “Game of Thrones” have to worry about the White Walkers. Harry Potter had to face the Inferi. Even Dr. Gregory House had to battle zombies, although it turned out he was only dreaming.

So it should scarcely come as a surprise that zombies have moaned and shuffled their way into politics -- including, unsurprisingly, the debate over gun control. This month, an article in the Guardian created a stir by analyzing AMC’s wildly popular serial “The Walking Dead” -- every episode of which features scenes in which the characters must either kill their way out of corners or die horribly -- and concluding that the program, properly understood, represents a call for more regulation of firearms.

...

We should look deeper. Zombie fiction is particularly popular among the young -- the same young, remember, who overwhelmingly believe that Social Security won’t be there when they retire. I suspect that zombie stories appeal to a generation that is secretly worried that government itself won’t make it; that the manifest inability of our politics to cope with today’s challenges suggests a likely incompetence at tackling tomorrow’s.