How's the future of the Eurozone economy look like?

Saturday, April 30, 2016

A Long, Uneven Recovery in Europe

The economy in Europe is finally got back where it used to be before the global recession in 2008. It has made progress since the crisis, but the European businesses continue to face challenges. China has taken up about 10 percent of Europe's exported wares last year. Increase in aging population is another problem that will further restrict the Eurozone economy.

How's the future of the Eurozone economy look like?

How's the future of the Eurozone economy look like?

Friday, April 29, 2016

Dark Money from foreign nations?

Remember the "social welfare" groups from the book Dark Money? The donors to these groups are kept secret from the public. Recently, the Republicans on the House Ways and Means Committee advanced to amend the tax code regarding to 501(c) "social welfare" groups in order to keep donors' identity from the IRS. This would open the door to secret, unaccountable money from foreign government, corporations, etc. What do you guys think?

Thursday, April 28, 2016

Current economy

The Obama administration has been going through the financial crisis and passed laws like the Dodd-Frank Wall Street Reform to limit risky actions of financial institutions and Consumer Protection Act. Do you guys think that the Obama administration handled the 2008 financial crisis well?

Ultimately, however, Obama said the lessons of his time in office are being misunderstood in the election campaigns. “If you look at the platforms, the economic platforms of the current Republican candidates for president, they don’t simply defy logic and any known economic theories, they are fantasy,” Obama said. “Slashing taxes particularly for those at the very top, dismantling regulatory regimes that protect our air and our environment and then projecting that this is going to lead to 5 percent or 7 percent growth, and claiming that they’ll do all this while balancing the budget. Nobody would even, with the most rudimentary knowledge of economics, think that any of those things are plausible.”

Ultimately, however, Obama said the lessons of his time in office are being misunderstood in the election campaigns. “If you look at the platforms, the economic platforms of the current Republican candidates for president, they don’t simply defy logic and any known economic theories, they are fantasy,” Obama said. “Slashing taxes particularly for those at the very top, dismantling regulatory regimes that protect our air and our environment and then projecting that this is going to lead to 5 percent or 7 percent growth, and claiming that they’ll do all this while balancing the budget. Nobody would even, with the most rudimentary knowledge of economics, think that any of those things are plausible.”

He continued: “If we can’t puncture some of the mythology around austerity, politics or tax cuts or the mythology that’s been built up around the Reagan revolution, where somehow people genuinely think that he slashed government and slashed the deficit and that the recovery was because of all these massive tax cuts, as opposed to a shift in interest-rate policy — if we can’t describe that effectively, then we’re doomed to keep on making more and more mistakes.”

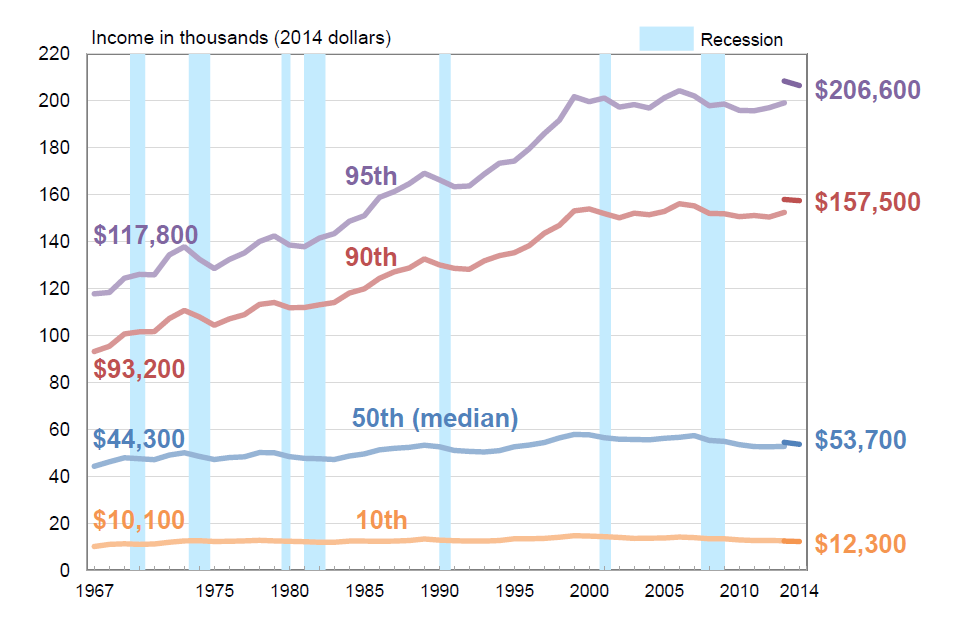

It seems like President Obama disagrees with the economic platforms of the current Republican candidates. I was wondering whether increasing taxes for the wealthy would possibly close the income inequality. Do you guys think that it would help redistribute the wealth?

Segregating ourselves by class and race

A data packed article in the New York Times (see here) shows changes in where the wealthiest of us live. The top 20% go to different schools, vote more, live in segregated neighborhoods.

The “truly advantaged” wing of the Democratic Party — a phrase coined in this newspaper

by Robert Sampson, a sociologist at Harvard — has provided the

Democratic Party with crucial margins of victory where its candidates

have prevailed. These upscale Democrats have helped fill the gap left by

the departure of white working class voters to the Republican Party.

At the same time, the priorities of the truly advantaged wing — voters with annual incomes in the top quintile, who now make up an estimated 26 percent

of the Democratic general election vote — are focused on social and

environmental issues: the protection and advancement of women’s rights,

reproductive rights, gay and transgender rights and climate change, and

less on redistributive economic issues.....A Democrat whose wallet tells him he is a Republican is unlikely to be a

strong ally of less well-off Democrats in pressing for tax hikes on the

rich, increased spending on the safety net or a much higher minimum

wage.

Wednesday, April 27, 2016

Relationship between income and longevity

I found this interesting article about the relationship between income and longevity. We often think that those with higher income would live longer and those with low income would not have a longer life span. It is true, but this article introduces more than that.

"One conclusion from this work, published on Monday in The Journal of the American Medical Association, is that the gap in life spans between rich and poor widened from 2001 to 2014. The top 1 percent in income among American men live 15 years longer than the poorest 1 percent; for women, the gap is 10 years. These rich Americans have gained three years of longevity just in this century. They live longer almost without regard to where they live. Poor Americans had very little gain as a whole, with big differences among different places."

http://www.nytimes.com/interactive/2016/04/11/upshot/for-the-poor-geography-is-life-and-death.html

"One conclusion from this work, published on Monday in The Journal of the American Medical Association, is that the gap in life spans between rich and poor widened from 2001 to 2014. The top 1 percent in income among American men live 15 years longer than the poorest 1 percent; for women, the gap is 10 years. These rich Americans have gained three years of longevity just in this century. They live longer almost without regard to where they live. Poor Americans had very little gain as a whole, with big differences among different places."

http://www.nytimes.com/interactive/2016/04/11/upshot/for-the-poor-geography-is-life-and-death.html

Tuesday, April 26, 2016

Import pressure causing extremism

Are foreign countries causing political extremism? This article from the NY Times seems to suggest so. We have discussed this idea in class a lot, and the Times seems to present a rationale for the political polarization that we have seen in recent years. The article explains how a small town in Alabama called Courtland that once had been a lively manufacturing location has essentially had the life taken out of it due to increasing imports from China. It goes on to introduce two residents, a mother and a daughter, who support Bernie Sanders and Donald Trump respectively. Both believe that these politicians are what America needs to be able to fight back pressures from Chinese imports. The essence of the article can be summed up in one quote, that “exposure to import competition is bad for centrists … We’ve known that political polarization and income inequality track each other, but that pattern is simply a correlation. We’ve now found a mechanism for how economic changes create further political divisions.”

Do you think this could be a reason why Sanders and Trump, both more polarized candidates, have seen a good degree of success in this election?Here's the article

More Antitrust

http://money.cnn.com/2016/04/25/media/charter-communications-time-warner-cable/

The article above states that the Department of Justice has just approved a merger between Charter, Time Warner Cable, and Bright House Networks. This merger will allow Charter to become the second largest cable provider in the country.

There are restrictions to Charter that include: no data caps or charging customers based on usage; and they cannot charge internet providers for connecting them with customers.

Why was this merger accepted? It seems to be pretty large and gives Charter a lot of power. Charter still need the approval of California's Public Utilities Commission in order for this deal to go through. Do you think this will be approved? What does this mean for the cable industry?

The article above states that the Department of Justice has just approved a merger between Charter, Time Warner Cable, and Bright House Networks. This merger will allow Charter to become the second largest cable provider in the country.

There are restrictions to Charter that include: no data caps or charging customers based on usage; and they cannot charge internet providers for connecting them with customers.

Why was this merger accepted? It seems to be pretty large and gives Charter a lot of power. Charter still need the approval of California's Public Utilities Commission in order for this deal to go through. Do you think this will be approved? What does this mean for the cable industry?

Its not about voting; it is about where you live

A great article to go along with this week's reading is linked below. From the article:

“Our pitch document said, look, there are 25 true swing congressional districts,” Jankowski told me as we sat in the conference room of his Richmond offices. “We went back to those races from 2002 to 2008, and we found that $115 million had been spent on those 25 congressional races. All hard dollars. We had a graphic on the screen: 115 million hard dollars or $20 million in soft and we can fix it. We can take control of these 25 districts. We can take them off the table.” They called their project REDMAP.

Jankowski’s foresight wasn’t the only factor in the GOP’s ensuing control of Congress. The party was also able to take advantage of massive new amounts of public data drawn from social media that allowed them to pinpoint likely voters with more accuracy than ever before, and advances in mapping technology that made it possible to redraw districts precisely around the location of those voters.

The result: The gerrymander of 2011 built such a firewall around GOP control of the House that when Barack Obama was reelected in 2012, Democratic congressional candidates earned 1.4 million more votes than Republicans, but the GOP retained a 234-201 majority.

1.4 million votes more for Democrats?

The GOP’s House Seats Are Safe. Here’s Why. -- NYMag

“Our pitch document said, look, there are 25 true swing congressional districts,” Jankowski told me as we sat in the conference room of his Richmond offices. “We went back to those races from 2002 to 2008, and we found that $115 million had been spent on those 25 congressional races. All hard dollars. We had a graphic on the screen: 115 million hard dollars or $20 million in soft and we can fix it. We can take control of these 25 districts. We can take them off the table.” They called their project REDMAP.

Jankowski’s foresight wasn’t the only factor in the GOP’s ensuing control of Congress. The party was also able to take advantage of massive new amounts of public data drawn from social media that allowed them to pinpoint likely voters with more accuracy than ever before, and advances in mapping technology that made it possible to redraw districts precisely around the location of those voters.

The result: The gerrymander of 2011 built such a firewall around GOP control of the House that when Barack Obama was reelected in 2012, Democratic congressional candidates earned 1.4 million more votes than Republicans, but the GOP retained a 234-201 majority.

1.4 million votes more for Democrats?

The GOP’s House Seats Are Safe. Here’s Why. -- NYMag

If a tree falls in the forest

More than 1300 people have been arrested in Washington DC as part of the Democracy Spring protests. See here for an update.

And see here for a list of organizations who support the movement.

If the protests are not widely reported in the media, does that mean they have little value?

And see here for a list of organizations who support the movement.

If the protests are not widely reported in the media, does that mean they have little value?

Monday, April 25, 2016

Will China help the middle class?

Hey guys, I just ran across this article from the New York Times that I found pretty interesting, since it pertains to some of the topics we have discussed in class. It explains how the middle-class has suffered pretty hard over the past few years, and it offers some reasons to have higher hopes looking forward. Such reasons include higher wages in China, technological innovation in China, increased trade, and even the presence of religion.

Personally, I think that these issues have a lot more to do with the distribution of wealth in the United States than these factors. They might help out the middle-class in some ways but I feel as though the effect will be minimal. What do you guys think? Are exogenous factors such as economic changes in China going to play a part in saving the middle class, or is it going to have to happen internally? Will it be a mix of both?

The Kochs Have Spoken

https://www.washingtonpost.com/news/post-politics/wp/2016/04/24/charles-koch-suggests-that-another-clinton-in-the-white-house-would-be-better-than-trump-or-cruz/

Read the article above.

According to this article, the Kochs believe that Hilary would be a better president than Trump or Cruz. Charles Koch also did not specifically answer if they will fully support Hilary if she wins the Democratic nomination. The Koch brothers have been very unhappy with the way the Republican Party is running things this election and they do not believe either candidate is worthy of the seat.

What do you think? Do you think the Kochs will take it easy this election or secretly endorse Hilary? Is it a good thing they are not happy with the Republican Party? Does this mean that Hilary is now on the Koch's payroll?

Read the article above.

According to this article, the Kochs believe that Hilary would be a better president than Trump or Cruz. Charles Koch also did not specifically answer if they will fully support Hilary if she wins the Democratic nomination. The Koch brothers have been very unhappy with the way the Republican Party is running things this election and they do not believe either candidate is worthy of the seat.

What do you think? Do you think the Kochs will take it easy this election or secretly endorse Hilary? Is it a good thing they are not happy with the Republican Party? Does this mean that Hilary is now on the Koch's payroll?

Sunday, April 24, 2016

Social Security

http://www.nytimes.com/2016/04/24/upshot/rich-people-are-living-longer-thats-tilting-social-security-in-their-favor.html?ref=business&_r=0

Above is an interesting article on social security for the wealthy versus everyone else. If the top 1% retire at the age of 66 and live until the age of 87 then they will end up with more money than they and everyone else paid in social security tax. Their internal rate of return would be 1.07%.

For those who are making about $30,000 per year, their internal rate of return would be 2.57%, which is significantly higher. This is nice to see, but these numbers are only true if they both live to be the same age.

Studies have shown that the rich tend to live longer, therefore receive more social security benefits.

After reading this article what do you guys think? Is social security another scam?

Above is an interesting article on social security for the wealthy versus everyone else. If the top 1% retire at the age of 66 and live until the age of 87 then they will end up with more money than they and everyone else paid in social security tax. Their internal rate of return would be 1.07%.

For those who are making about $30,000 per year, their internal rate of return would be 2.57%, which is significantly higher. This is nice to see, but these numbers are only true if they both live to be the same age.

Studies have shown that the rich tend to live longer, therefore receive more social security benefits.

After reading this article what do you guys think? Is social security another scam?

An interesting summary on Dark Money topics

See the link here.

There has been some talk lately that since Jeb Bush, Scott Walker (a

Koch favorite) and others who had Big Money dropped out of the race for

the Republican nomination, money is not the factor in politics many

thought it would be after the Supreme Court unleashed the money wolves

in Citizens United. This is nonsense. Presidential campaigns are the worst barometer to measure the impact of money on politics.

The race for the presidency is covered by the national media in

excessive and excrutiating detail. At least the leading candidates

are. No amount of advertising can match the free advertising of the

news media, as Donald Trump proves conclusively. With the leaders

covered so intensely, a dull or “low energy” candidate such as Jeb Bush,

or a difficult personality such as Scott Walker, will only rarely

succeed even with freight cars of cash.

But the media coverage is less intense for even U.S. senate races,

and virtually non-existent for state legislative and congressional

campaigns. Here is where the uber rich have found rich returns, as

Mayer describes. Plus, the uber rich, as well as other wealthy

businessmen, have found equal rewards in funding “grass roots” campaigns

through TV ads. This is how the Tea Party got traction and why

citizens raged against the Affordable Care Act for no truly articulable

and truthful reason.

There has been some talk lately that since Jeb Bush, Scott Walker (a

Koch favorite) and others who had Big Money dropped out of the race for

the Republican nomination, money is not the factor in politics many

thought it would be after the Supreme Court unleashed the money wolves

in Citizens United. This is nonsense. Presidential campaigns are the worst barometer to measure the impact of money on politics.

The race for the presidency is covered by the national media in

excessive and excrutiating detail. At least the leading candidates

are. No amount of advertising can match the free advertising of the

news media, as Donald Trump proves conclusively. With the leaders

covered so intensely, a dull or “low energy” candidate such as Jeb Bush,

or a difficult personality such as Scott Walker, will only rarely

succeed even with freight cars of cash.

But the media coverage is less intense for even U.S. senate races,

and virtually non-existent for state legislative and congressional

campaigns. Here is where the uber rich have found rich returns, as

Mayer describes. Plus, the uber rich, as well as other wealthy

businessmen, have found equal rewards in funding “grass roots” campaigns

through TV ads. This is how the Tea Party got traction and why

citizens raged against the Affordable Care Act for no truly articulable

and truthful reason.

Charles Koch supporting Clinton?

Here's an interesting article from Politico that discusses a recent interview with Charles Koch (here's a short clip from the interview) in which he suggests that Hillary Clinton could make a better candidate than any Republican candidate. Given the track record of Koch, I found this pretty interesting. Does this surprise any of you? Let me know what you guys think.

For those of you who took accounting from Moffit

It will serve you well in navigating a world like this.

Fantasy Math Is Helping Companies Spin Losses Into Profits - The New York Times

Fantasy Math Is Helping Companies Spin Losses Into Profits - The New York Times

Saturday, April 23, 2016

Questionable Health Insurance

http://money.cnn.com/2016/04/19/investing/unitedhealthcare-obamacare-exchanges-aca/index.html

United Health Care is one of the largest health insurers in the US and has decided it doesn't like Obamacare. United Health Care has decided to drop coverage of those states with Obamacare exchanges. Their earnings have dropped since the establishment of Obamacare because those who are "too dangerous" to insure chose to receive Obamacare. United Health Care has decided that by 2017 it will leave most states.

What does this mean for people trying to get health insurance? Is there a bright future for Obamacare? What will happen when there is a new president elected? If Bernie gets elected and created universal health care, there will be no need for health insurance companies. Do you think health insurance companies will start "buying" people in the government if this happens?

United Health Care is one of the largest health insurers in the US and has decided it doesn't like Obamacare. United Health Care has decided to drop coverage of those states with Obamacare exchanges. Their earnings have dropped since the establishment of Obamacare because those who are "too dangerous" to insure chose to receive Obamacare. United Health Care has decided that by 2017 it will leave most states.

What does this mean for people trying to get health insurance? Is there a bright future for Obamacare? What will happen when there is a new president elected? If Bernie gets elected and created universal health care, there will be no need for health insurance companies. Do you think health insurance companies will start "buying" people in the government if this happens?

When Lobbying was Illegal...not that long ago

Over the past two decades, the Supreme Court has sanctioned any lobbying that is not explicit, quid pro quo bribery.

A 1999 Supreme Court case, for example, overturned

a federal law that banned officials from receiving gifts. A farmer’s

association had given the Secretary of Agriculture sports tickets,

luggage, and free meals—all delivered by hiring the Secretary’s college

roommate as a lobbyist—and then benefited from policies made by the

Secretary. Yet the court sanctioned the act. Justice Scalia wrote that

banning all gifts would lead to “absurdities,” and he could not imagine banning an organization from organizing a free lunch for a policymaker.

a federal law that banned officials from receiving gifts. A farmer’s

association had given the Secretary of Agriculture sports tickets,

luggage, and free meals—all delivered by hiring the Secretary’s college

roommate as a lobbyist—and then benefited from policies made by the

Secretary. Yet the court sanctioned the act. Justice Scalia wrote that

banning all gifts would lead to “absurdities,” and he could not imagine banning an organization from organizing a free lunch for a policymaker.

Similarly, in the Citizens United case, Justice Anthony Kennedy, writing the majority’s opinion, noted that “Ingratiation and access… are not corruption.”

This

logic and these conclusions, Teachout contends, are a complete break

from the reasoning of judges in 18th and 19th century America.

Forlogic and these conclusions, Teachout contends, are a complete break

from the reasoning of judges in 18th and 19th century America.

100 years, judges so believed that using personal influence to

ingratiate and gain access to lawmakers led to corruption that they

refused to enforce lobbying contracts. Teachout cites

a 19th century legal textbook that stated that “what are known as

‘lobbying contracts’. . . [which are] any agreements to render services

in procuring legislative action… by personal solicitation of the

legislators or other objectionable means, is contrary to the plainest

principles of public policy, and is void.”

Read the rest at:

When Lobbying was Illegal

Liberals know you don't know what is best for you

A nice piece in Vox sets out the theme (go here). "There is a smug style in American liberalism. It has been growing these

past decades. It is a way of conducting politics, predicated on the

belief that American life is not divided by moral difference or policy

divergence — not really — but by the failure of half the country to know

what's good for them." Traditional Democratic voters went Republican in the latter half of the twentieth century. The consequence was a shift in liberalism's intellectual center of

gravity. A movement once fleshed out in union halls and little magazines

shifted into universities and major press, from the center of the

country to its cities and elite enclaves. Minority voters remained, but

bereft of the material and social capital required to dominate elite

decision-making, they were largely excluded from an agenda driven by the

new Democratic core: the educated, the coastal, and the professional.

Great article.

past decades. It is a way of conducting politics, predicated on the

belief that American life is not divided by moral difference or policy

divergence — not really — but by the failure of half the country to know

what's good for them." Traditional Democratic voters went Republican in the latter half of the twentieth century. The consequence was a shift in liberalism's intellectual center of

gravity. A movement once fleshed out in union halls and little magazines

shifted into universities and major press, from the center of the

country to its cities and elite enclaves. Minority voters remained, but

bereft of the material and social capital required to dominate elite

decision-making, they were largely excluded from an agenda driven by the

new Democratic core: the educated, the coastal, and the professional.

Great article.

Friday, April 22, 2016

Jobless claims at 42-year low

I just found this article from MarketWatch.com that discusses how jobless claims have fallen to a 42-year low based on estimates from new applications for unemployment benefits. As we know in economics, unemployment and inflation are a trade-off, but as of late, the inflation rate has been exceptionally low. It doesn't seem right to question a low unemployment rate, but, as we have learned in class, the Fed is supposed to ensure stable economic growth, and this situation almost seems too good to be true.

So, do you think that this is stable growth? How do you think the Fed should react? How should we feel about this looking forward?

Happy Earth Day

Today 155 countries are meeting in New York to sign the Paris Agreement on Climate Change. The goal of these countries is to limit the rise of the Earth's temperatures by 2 degrees Celsius. These countries will cut 55% of greenhouse gas emissions in order to meet this goal.

Here is a list of all the countries signing the agreement:

http://www.un.org/sustainabledevelopment/blog/2016/04/parisagreementsingatures/

Here is a link to the article discussing the conference:

http://www.accuweather.com/en/weather-news/record-number-of-countries-to-sign-paris-agreement-of-climate-change-on-earth-day/56844796

What economic affects will this have on the United States as well as the world? What do you think the Koch brothers think about this agreement and what impact will it have on their business?

Here is a list of all the countries signing the agreement:

http://www.un.org/sustainabledevelopment/blog/2016/04/parisagreementsingatures/

Here is a link to the article discussing the conference:

http://www.accuweather.com/en/weather-news/record-number-of-countries-to-sign-paris-agreement-of-climate-change-on-earth-day/56844796

What economic affects will this have on the United States as well as the world? What do you think the Koch brothers think about this agreement and what impact will it have on their business?

My dollars .... your preferences

The Koch brothers are lobbying hard for the right to mine uranamium in the Grand Canyon. (see link) A proposed coservation measure would ban mining from 1.7 million acres around the canyon. The proposal is supported by 80% of Arizona residents, environmental

groups, and native tribes, the Guardian reports. Yet, Greg Zimmerman

of the Center for Western Priorities has found that a non-profit group,

the Prosper Foundation, is fighting to block the move..... Proponents of the ban observe that uranium mining has been proven

to cause cancer in those working the mines, as well as in Native

Americans, whose water is contaminated by the process.

I wonder which side will win?

groups, and native tribes, the Guardian reports. Yet, Greg Zimmerman

of the Center for Western Priorities has found that a non-profit group,

the Prosper Foundation, is fighting to block the move..... Proponents of the ban observe that uranium mining has been proven

to cause cancer in those working the mines, as well as in Native

Americans, whose water is contaminated by the process.

I wonder which side will win?

Thursday, April 21, 2016

McDonald's Trims the Fat

Hey guys, I just found this article from The Fortune that discusses the positive changes that have happened to McDonald’s following its implementation of higher wages and better benefits for its workers. As the title states, service has improved for the company, but the article also mentions that turnover rates have improved, and the company grew about 6% in the quarter following the implementation of these new wages and benefits.

McDonald’s isn’t the first company to raise wages for its employees, companies such as WalMart and Costco have also raised wages and benefits for their workers, and seen similar results. However, it is worth mentioning that, as this article states, McDonald’s has been laying off a lot of workers as of late, and seems to be trimming the fat within their corporation. Essentially, they’re cutting out what they don’t need, and using the extra cash they’ve saved to help out other more efficient workers.

So, do you think that this business model is effective? Do you predict that other companies will be following suit? They might be saving money, but do you think that this will be good for the country, since so many people might lose their jobs if this policy is adopted by other companies?

New Currency

It has recently been decided that Harriet Tubman will now replace Andrew Jackson on the 20 dollar bill. This change is expected to happen in 2020. There has been a lot of positive feedback saying that it is about time that a woman is featured on our currency. There has been some back and forth to whether Tubman should be on the 10 dollar bill instead of Alexander Hamilton, but there are plans to remove him from the bill as well. People believe that Jackson should be removed because "Jackson was a scoundrel, a slave holder and a white supremacist who was involved in the removal of Indians and was completely opposed to paper money and was horrible to women." Hamilton is believed to be a hero to this country and has done great things for our advancement.

What do you guys think? Do you think it is a good idea to change the currency to a woman? Is Harriet Tubman the right choice? Do you think that taking Jackson off the currency is an insult to his reputation? Should it have been Hamilton? Or does reputation not matter?

http://www.politico.com/story/2016/04/treasurys-lew-to-announce-hamilton-to-stay-on-10-bill-222204

Wednesday, April 20, 2016

LA Unions Backtrack on Wage Increases

Hey guys, I just found this really interesting article from The Guardian pertaining to an interesting situation with LA’s unions. The article states that, after fighting for a $15 minimum wage within their city, unions are now attempting to exempt themselves from the rule, stating that it would allow workers to negotiate benefits with their workers more effectively. It goes on to state that union membership has been steadily decreasing throughout the past several decades. However, this creates an interesting situation, since the only place that businesses within LA are going to find labor for below $15 an hour is within the unions, which will cause businesses to flood the unions, and there will be little or no non-union labor left.

What do you guys think the implications of this are? Will it be better, from an economic standpoint, for there to be so much union participation? Does it give too much power to the unions? Could this have been a ploy by the unions to get participation to increase?

Is Google going too far?

The European Union has filed an antitrust complaint to Google because they have contracts with Android producers to have their apps preinstalled on smartphones. Androids make up about 70% of all the phones used in the EU. It is believed that these preloaded apps make it hard for competitors to enter the market because if the app is already installed people will not go looking for another one. However, Google has not created programs to block other competing apps from being downloaded, so buying competitors apps are still possible.

This article goes into further detail:

http://www.bloomberg.com/news/articles/2016-04-20/google-s-curbs-on-phone-makers-choke-app-competition-eu-says

What do you guys think? Is Google in violation of any antitrust laws or is the fact that downloading other apps is still possible enough of a reason to say this is allowed? Will this case change anything about technology?

This article goes into further detail:

http://www.bloomberg.com/news/articles/2016-04-20/google-s-curbs-on-phone-makers-choke-app-competition-eu-says

What do you guys think? Is Google in violation of any antitrust laws or is the fact that downloading other apps is still possible enough of a reason to say this is allowed? Will this case change anything about technology?

Billionaires and elections

From the Philadelphia Inquirer: Sanders made less for a year of exhausting work on Capitol Hill than

his primary opponent, Hillary Clinton, earned from ONE SPEECH that she

delivered to the massive vampire squid of global capitalism, Goldman

Sachs, which paid her a cool $225,000 for a 45-minute job of a speech, a fee that was paid to the once and would-be future White House resident on three separate occasions. (Because, as Hillary shrugged in a 2015 debate, "that's what they offered.")That's not all. In 2014, Hillary and her ex-president husband Bill

Clinton earned just over $28 million, or a whopping 135 times as much as

the Sanders household. Their

income that year came from giving speeches ($10.5 million for Hillary

Clinton, $9.8 million for Bill) and $6.4 million in consulting (or

as USA Today called it, "consulting") by the former president. Also

known as trading on their political clout as once and possibly future

leaders of the United States of America....

Ordinary Americans are angry. The article goes on to point out: Over the last week in Washington, D.C., a staggering number of people -- at least 900, with more in the works -- have been arrested for sitting-in at the U.S. Capitol, all to support new restrictions on the influence of millionaire-and-billionaire dollars in American politics and to roll back the recent wave of limitations on voting. The Democracy Spring protesters are the vanguard of a growing revolt that is looking outside-the-box of conventional U.S. politics, to attack the corruption at its root source. Not surprisingly, the major media outlets -- which reap millions from the current system of political advertising -- have imposed a virtual news blackout on Democracy Spring.

And then there is this: At the time the Panama Papers story broke, U.S. tax experts said there was no need for Americans to hide wealth in places like Panama when we have havens right here in places like...Delaware. In fact, you'll be shocked (OK, probably not shocked) to learn that when Bill and Hillary Clinton found themselves in private life and making the real dough, the couple was involved in the creation of five Delaware corporations -- three related to the Clinton Foundation non-profit, one for Bill's "consulting" fees, and one for a $5.5 million Hillary book advance. Why take advantage of the low tax rates and limited public-disclosure laws of the American Cayman Islands? I guess that's what Delaware offered...... The defenders of the Clintons say they money doesn't matter as long as her opponents can't demonstrate a quid pro quo. First, the weeds can get pretty quick, but take a second to read this, or this, stories that raise serious questions of a conflict of interest. Second, these self-proclaimed progressives seem to have forgotten the first rule of political graft, which is that the appearance of corruption is just as bad as demonstrable corruption itself.

Take the example of Verizon, where about 40,000 workers are currently on strike, protesting both the steady drip of jobs overseas and the endless flow of resources away from the middle class and toward a tiny band of corporate elites. "My co-workers and I aren’t asking for $18m a year," one striker wrote, referring to the paycheck of Verizon's CEO. "We’d just like to take care of our families." In the Democratic primary, both Clinton and Sanders issued statements of support, and the Vermonter gained some added cred by walking the picket line. Clinton should probably lose some cred, though, since Verizon paid her $225,000 -- that's what they offered -- for a May 2013 speech and showered donations on the Clinton Foundation. That's the appearance of corruption -- when it's not unreasonable to wonder whether a President Hillary Clinton would really be on the side of the picketers...or her corporate benefactor?

Read the rest of the article here. It is not just a monopoly game.

Ordinary Americans are angry. The article goes on to point out: Over the last week in Washington, D.C., a staggering number of people -- at least 900, with more in the works -- have been arrested for sitting-in at the U.S. Capitol, all to support new restrictions on the influence of millionaire-and-billionaire dollars in American politics and to roll back the recent wave of limitations on voting. The Democracy Spring protesters are the vanguard of a growing revolt that is looking outside-the-box of conventional U.S. politics, to attack the corruption at its root source. Not surprisingly, the major media outlets -- which reap millions from the current system of political advertising -- have imposed a virtual news blackout on Democracy Spring.

And then there is this: At the time the Panama Papers story broke, U.S. tax experts said there was no need for Americans to hide wealth in places like Panama when we have havens right here in places like...Delaware. In fact, you'll be shocked (OK, probably not shocked) to learn that when Bill and Hillary Clinton found themselves in private life and making the real dough, the couple was involved in the creation of five Delaware corporations -- three related to the Clinton Foundation non-profit, one for Bill's "consulting" fees, and one for a $5.5 million Hillary book advance. Why take advantage of the low tax rates and limited public-disclosure laws of the American Cayman Islands? I guess that's what Delaware offered...... The defenders of the Clintons say they money doesn't matter as long as her opponents can't demonstrate a quid pro quo. First, the weeds can get pretty quick, but take a second to read this, or this, stories that raise serious questions of a conflict of interest. Second, these self-proclaimed progressives seem to have forgotten the first rule of political graft, which is that the appearance of corruption is just as bad as demonstrable corruption itself.

Take the example of Verizon, where about 40,000 workers are currently on strike, protesting both the steady drip of jobs overseas and the endless flow of resources away from the middle class and toward a tiny band of corporate elites. "My co-workers and I aren’t asking for $18m a year," one striker wrote, referring to the paycheck of Verizon's CEO. "We’d just like to take care of our families." In the Democratic primary, both Clinton and Sanders issued statements of support, and the Vermonter gained some added cred by walking the picket line. Clinton should probably lose some cred, though, since Verizon paid her $225,000 -- that's what they offered -- for a May 2013 speech and showered donations on the Clinton Foundation. That's the appearance of corruption -- when it's not unreasonable to wonder whether a President Hillary Clinton would really be on the side of the picketers...or her corporate benefactor?

Read the rest of the article here. It is not just a monopoly game.

Tuesday, April 19, 2016

2016 Already Shows Record Global Temperatures

Climate change is a serious issue facing the world. America has seemingly lacked in meaningful environmental policies to help slow the pace of global warming. The article below describes the fact that temperatures are already at record levels this year. Do you think presidential candidates are discussing climate change enough? Do you think a republican president would promote environmental policies?

http://www.nytimes.com/2016/04/20/science/2016-global-warming-record-temperatures-climate-change.html?ref=business&_r=0

Why the Great Divide is Growing between Affordable and Expensive U.S Cities

Since the 1950s U.S cities have been expanding rapidly and have added about 10,000 miles per decade, but beneath the surface the divide between expensive and affordable cities has also been growing. Since the 1970s, large cities such as San Francisco, Boston, New York and Miami have slowed their expansion, while other cities in the Southeast and Texas have grown much more dramatically yet have seen a much slower price growth.

For example a developed residential area in Atlanta grew 208% from 1980 to 2010 while home values grew 14%, while in the San Francisco- San Jose area land grew by 30% while home values grew by 188%. One expert says "If you don't let the city grow, you're going to get prices going upward and see the middle class being pushed out". We have talked a lot previously about why the middle class in the U.S is disappearing, do you think that the difference between expansive and expensive cities is a major factor is a reason for the declining middle class, and what do you think that could be done because many of the expensive cities are prevented from outward growth due to natural barriers? Also how do you think the relationship between house values and area affected the housing crisis that led to the financial crisis in 2008?

http://blogs.wsj.com/economics/2016/04/18/why-the-great-divide-is-growing-between-affordable-and-expensive-u-s-cities/

For example a developed residential area in Atlanta grew 208% from 1980 to 2010 while home values grew 14%, while in the San Francisco- San Jose area land grew by 30% while home values grew by 188%. One expert says "If you don't let the city grow, you're going to get prices going upward and see the middle class being pushed out". We have talked a lot previously about why the middle class in the U.S is disappearing, do you think that the difference between expansive and expensive cities is a major factor is a reason for the declining middle class, and what do you think that could be done because many of the expensive cities are prevented from outward growth due to natural barriers? Also how do you think the relationship between house values and area affected the housing crisis that led to the financial crisis in 2008?

http://blogs.wsj.com/economics/2016/04/18/why-the-great-divide-is-growing-between-affordable-and-expensive-u-s-cities/

RollCall.com - Wealth of Congress

Almost 200 members of Congress are millionaires. Does that affect how they perceive the need for social programs?

RollCall.com - Wealth of Congress

RollCall.com - Wealth of Congress

I wonder what he believes and if it matters.....

From the link below:

Ted Cruz declares that his religious faith defines who he is. To that end, he has stated,

"When I fight to defend religious liberty, it's not purely a

constitutional matter; it's a lifelong passion and personal commitment.

When I stand to defend life and marriage, it is a core tenet of my

faith."

As journalist Bill Berkowitz observed,

"Ted Cruz is a seven-mountain guy and those mountains have nothing to

do with Everest, Kilimanjaro, Whitney or any of the world's renowned

peaks. Cruz's seven mountains have to do with reclaiming, rebuilding,

and reestablishing America as a Christian country, which means

Christians taking dominion over seven aspects of culture: family,

religion, education, media, entertainment, business and government."

Senator Cruz also surrounds himself with high-profile Dominionists.

The list includes his father and campaign surrogate, preacher Rafael

Cruz; revisionist historian David Barton; and retired US Army General

William G. "Jerry" Boykin (now advising the candidate on foreign

policy).

| One Simple Question for Ted Cruz

Ted Cruz declares that his religious faith defines who he is. To that end, he has stated,

"When I fight to defend religious liberty, it's not purely a

constitutional matter; it's a lifelong passion and personal commitment.

When I stand to defend life and marriage, it is a core tenet of my

faith."

As journalist Bill Berkowitz observed,

"Ted Cruz is a seven-mountain guy and those mountains have nothing to

do with Everest, Kilimanjaro, Whitney or any of the world's renowned

peaks. Cruz's seven mountains have to do with reclaiming, rebuilding,

and reestablishing America as a Christian country, which means

Christians taking dominion over seven aspects of culture: family,

religion, education, media, entertainment, business and government."

Senator Cruz also surrounds himself with high-profile Dominionists.

The list includes his father and campaign surrogate, preacher Rafael

Cruz; revisionist historian David Barton; and retired US Army General

William G. "Jerry" Boykin (now advising the candidate on foreign

policy).

| One Simple Question for Ted Cruz

Monday, April 18, 2016

Differences in Ideologies in the Media

Below, I've posted a couple of sites that illustrate the political ideology of the major news sources in the United States. There were a few points I found interesting. First, liberals are much more trusting of news sources than conservatives Second, it seems like there are more left-leaning news sources than right-leaning. I think understanding the ideological differences is an important issue because there have been so many complaints about media from both sides of the spectrum about the media. Do you think that these differences result in misleading news? Do you think the news sources are remaining neutral in their reporting?

http://www.businessinsider.com/what-your-preferred-news-outlet-says-about-your-political-ideology-2014-10

https://www.washingtonpost.com/news/the-fix/wp/2014/10/21/lets-rank-the-media-from-liberal-to-conservative-based-on-their-audiences/

http://www.journalism.org/2014/10/21/section-1-media-sources-distinct-favorites-emerge-on-the-left-and-right/

http://www.ijreview.com/2014/10/191709-nonpartisan-chart-reveals-whos-trusting-major-news-sources-liberals-conservatives/

http://www.businessinsider.com/what-your-preferred-news-outlet-says-about-your-political-ideology-2014-10

https://www.washingtonpost.com/news/the-fix/wp/2014/10/21/lets-rank-the-media-from-liberal-to-conservative-based-on-their-audiences/

http://www.journalism.org/2014/10/21/section-1-media-sources-distinct-favorites-emerge-on-the-left-and-right/

http://www.ijreview.com/2014/10/191709-nonpartisan-chart-reveals-whos-trusting-major-news-sources-liberals-conservatives/

Are Trump and Sanders just as similar as they are different

As different as they are and as much as they disagree on major topics, Trump and Sanders share remarkable similarities that show how voters views on politics may be shifting. Last year many people assumed that the 2016 election would be Jeb Bush vs. Hillary Clinton in a battle between two political families, however one year later things could not be more different. The emergence of the two outside candidates has thrown a wrench into the election, and while they differ greatly on many views they also have some similar views. For example both are against super PACs and do not have to spend time as wealthy people for money. While they have raised money in different ways (Trump has self-funded his campaign and Bernie has produced a record number of contributions), it is interesting they both oppose such a powerful concept. They also share their dismay with their party rules.

However, I think it interesting that they also agree on policy issues. Both Trump and Sanders have issues with current trade deal that have hurt the country, they have both opposed the war in Iraq, and they have similar view on the role of the U.S in the N.A.T.O.

This article by the Washington Post made me think, as different as these candidates are, could their limited similarities and surprising results, lead to a shift in future elections, where more outside candidates have better chances? Or is this year, with these two particular candidates an oddity that will not be replicated?

https://www.washingtonpost.com/politics/trump-and-sanders-find-common-ground-despite-deep-dislike-for-each-other/2016/04/16/8d33c9fe-0354-11e6-9203-7b8670959b88_story.html

However, I think it interesting that they also agree on policy issues. Both Trump and Sanders have issues with current trade deal that have hurt the country, they have both opposed the war in Iraq, and they have similar view on the role of the U.S in the N.A.T.O.

This article by the Washington Post made me think, as different as these candidates are, could their limited similarities and surprising results, lead to a shift in future elections, where more outside candidates have better chances? Or is this year, with these two particular candidates an oddity that will not be replicated?

https://www.washingtonpost.com/politics/trump-and-sanders-find-common-ground-despite-deep-dislike-for-each-other/2016/04/16/8d33c9fe-0354-11e6-9203-7b8670959b88_story.html

Sunday, April 17, 2016

Media Websites Battle Faltering Ad Revenue and Traffic

In the article below, there was a quote that stood out to me. "Advertisers adjusted spending accordingly. In the first quarter of 2016, 85 cents of every new dollar spent in online advertising will go to Google or Facebook."

Are Facebook and Google monopolizing the Internet. Will smaller media websites be able to survive as Google and Facebook continue to expand their reach and power on the Internet?

http://www.nytimes.com/2016/04/18/business/media-websites-battle-falteringad-revenue-and-traffic.html?ref=business&_r=0

Trump and RNC

While Trump has a large lead in delegates and is the favorite to win the Republican Nomination, his biggest challenge may not come from another candidate but from the Republican National Committee itself. During his entire campaign Trump has had an escalating fight with RNC, and his frustration with the process has only been growing. He is currently at the point where he is basically threatening the RNC. In a piece by the Washington Post, he is quoted as saying "The Republican National Committee, they'd better get going, because I'll tell you whatL You're going to have a rough July at that convention,". He made this comment yesterday at a rally in Syracuse, and the timing of this is interesting because in a few days the RNC will hold their spring meeting, and their could be a discussion of how the nominee would be selected.

While Trump has repeatedly bullied opposing candidates, do think he is going to far by trying to bully the RNC as a whole, and do you think his threatening tactics will continue to work to cause changes in the way the nominee is selected?

https://www.washingtonpost.com/news/post-politics/wp/2016/04/16/trump-to-rnc-reform-nomination-system-or-have-a-rough-july-at-that-convention/

While Trump has repeatedly bullied opposing candidates, do think he is going to far by trying to bully the RNC as a whole, and do you think his threatening tactics will continue to work to cause changes in the way the nominee is selected?

https://www.washingtonpost.com/news/post-politics/wp/2016/04/16/trump-to-rnc-reform-nomination-system-or-have-a-rough-july-at-that-convention/

The US Government Loses As Much As $111 Billion Annually Due to Corporate Tax Dodging -

Clausing found that by 2012, the annual revenue cost to

the US government due to corporate tax dodging had amounted to $77-111

billion. For the world as a whole, she estimated revenue losses to be

above $280 billion. (Last year, IMF economists

Ernesto Crivelli, Ruud De Mooij, and Michael Keen estimated that

developing countries lose $105 billion each year due to tax base

erosion)....The report, a financial analysis of America’s 50

largest public companies—multinational corporations like Alphabet,

Apple, Goldman Sachs, and Disney—details an “opaque and secretive

network” of 1,608 disclosed subsidiaries based in tax havens like the

Cayman Islands, in addition to thousands of additional subsidiaries that

these companies “may have failed to disclose to the Securities and

Exchange Commission due to weak reporting requirements.”

The US Government Loses As Much As $111 Billion Annually Due to Corporate Tax Dodging -

the US government due to corporate tax dodging had amounted to $77-111

billion. For the world as a whole, she estimated revenue losses to be

above $280 billion. (Last year, IMF economists

Ernesto Crivelli, Ruud De Mooij, and Michael Keen estimated that

developing countries lose $105 billion each year due to tax base

erosion)....The report, a financial analysis of America’s 50

largest public companies—multinational corporations like Alphabet,

Apple, Goldman Sachs, and Disney—details an “opaque and secretive

network” of 1,608 disclosed subsidiaries based in tax havens like the

Cayman Islands, in addition to thousands of additional subsidiaries that

these companies “may have failed to disclose to the Securities and

Exchange Commission due to weak reporting requirements.”

The US Government Loses As Much As $111 Billion Annually Due to Corporate Tax Dodging -

More on democracy

Should voters be allowed to choose their president?

Indiana Awards 57 Delegates Before Primary Vote, Only 1 to Trump; Satan vs. Trump | MishTalk

Indiana Awards 57 Delegates Before Primary Vote, Only 1 to Trump; Satan vs. Trump | MishTalk

Friday, April 15, 2016

Should we even be worried about the national debt?

Is the national debt something that private citizens should really be worried about? While the national debt total is about $13.9 trillion (or $42,998.12 a person), it does not mean that each citizen has to pay their part, because the debt can roll over. The government on the other had only has to pay back the interest it owes (to keep getting money from investors), and with interest rates held so low is it even worth cutting the debt.

This article by Washington Post with a critique of Time article by Jim Grant, shows the two sides to this debate. Do you think the national debt is even worth trying to cut?

https://www.washingtonpost.com/news/wonk/wp/2016/04/15/this-is-the-worst-argument-about-the-national-debt-youll-ever-find/

Voting rights are for suckers

From the Washington Post: Ivanka and Eric Trump ran afoul of New York’s overly restrictive voting laws. New York does not allow

same-day registration, party primaries are open only to registered

Democrats and Republicans, and new voters must register at least 25 days

in advance in order to participate. Most absurdly, anyone registered to

vote who wanted to change their party registration to vote in Tuesday’s

primary needed to have done so by Oct. 9 of last year. This is the rule

that tripped up the unaffiliated Trumps. Six months before the primary? What purpose does that serve beyond suppressing democracy?

Donald Trump’s kids can’t vote for their dad. That’s no laughing matter. - The Washington Post

same-day registration, party primaries are open only to registered

Democrats and Republicans, and new voters must register at least 25 days

in advance in order to participate. Most absurdly, anyone registered to

vote who wanted to change their party registration to vote in Tuesday’s

primary needed to have done so by Oct. 9 of last year. This is the rule

that tripped up the unaffiliated Trumps. Six months before the primary? What purpose does that serve beyond suppressing democracy?

Donald Trump’s kids can’t vote for their dad. That’s no laughing matter. - The Washington Post

Thursday, April 14, 2016

Can a Higher Minimum Wage Increase Productivity?

Increasing the minimum wage is a big debate in politics right now. 13 states are set to have their minimum wage increase in 2016, including Michigan and California. In addition, there are 15 states that index their minimum wage to increase as the cost of living increases. Many are advocating to raise the federal minimum wage to $15.

A number of studies have found that these increases do not necessarily benefit the target: the poor. However, the article cited below argues that higher wages could lead to increased productivity. "Some British companies that voluntarily shifted to a higher living wage found that staff absenteeism and turnover rates reduced, and productivity improved."

Is this because a better-paid staff is more motivated? Or are employers forced to become more efficient to absorb the cost of higher wages? Does the distinction matter? Do you think the proposed increase of the minimum wage in the United States would increase productivity?

http://www.economist.com/blogs/buttonwood/2016/04/minimum-wages

A number of studies have found that these increases do not necessarily benefit the target: the poor. However, the article cited below argues that higher wages could lead to increased productivity. "Some British companies that voluntarily shifted to a higher living wage found that staff absenteeism and turnover rates reduced, and productivity improved."

Is this because a better-paid staff is more motivated? Or are employers forced to become more efficient to absorb the cost of higher wages? Does the distinction matter? Do you think the proposed increase of the minimum wage in the United States would increase productivity?

http://www.economist.com/blogs/buttonwood/2016/04/minimum-wages

What could happen at the Republican convention?

While it Trump currently holds a large lead in delegates (which will most likely grow after the New York and Pennsylvania primaries), it is still unlikely that he will receive the necessary 1,237 delegates to win the nomination out right. Which brings the question what will happen at the Republican Convention in June and who will win the nomination? The outcome of this decision has huge political implications for the U.S, however some top New England Republicans such as Massachusetts governor Charlie Baker, as well as several Vermont Senators plan on skipping the convention. While they have their own obligations in their home states, shouldn't their primary focus be on the Republican Convention to determine to Republican nominee?

https://www.bostonglobe.com/metro/2016/04/14/top-republicans-skip-gop-convention/XCl5W6CiiKKGIdb9RZx1xL/story.html

https://www.bostonglobe.com/metro/2016/04/14/top-republicans-skip-gop-convention/XCl5W6CiiKKGIdb9RZx1xL/story.html

Canadian who hid turtles in trousers is jailed in US - BBC News

This guy is going to jail. But not the guys on Wall Street. Hhmm.......

Canadian who hid turtles in trousers is jailed in US - BBC News

Canadian who hid turtles in trousers is jailed in US - BBC News

Democracy Spring

Rolling Stone has a great article on the protests that Jay talked about Tuesday night. I haven't seen much about them on the network news. Have you?

Why Thousands of Americans Are Lining Up to Get Arrested in D.C. | Rolling Stone

Why Thousands of Americans Are Lining Up to Get Arrested in D.C. | Rolling Stone

Democratic Party of Wisconsin helps billionaires channel donations to Clinton campaign | Wisconsin Citizens Media Cooperative

Right wing, center, or left wing: money talks in elections.

UPDATED: Democratic Party of Wisconsin helps billionaires channel donations to Clinton campaign | Wisconsin Citizens Media Cooperative

UPDATED: Democratic Party of Wisconsin helps billionaires channel donations to Clinton campaign | Wisconsin Citizens Media Cooperative

Disaster Capitalism's Coming Use of The Lead Water Pipe Crisis - YouTube

This is a seven minute video on Flint's water crisis. Two things I found interesting: first, since this is "news from the left," I found myself discounting it just as I do "news from the right." Second, the role of private capital in Flint and elsewhere is interesting. What do you think of the video?

Disaster Capitalism's Coming Use of The Lead Water Pipe Crisis - YouTube

Disaster Capitalism's Coming Use of The Lead Water Pipe Crisis - YouTube

The TTP: Would it be good for America?

The answer depends on your class orientation. I like the fact-checking piece linked below. Check it out.

Fact-checking the campaigns for and against the TPP trade deal - The Washington Post

Fact-checking the campaigns for and against the TPP trade deal - The Washington Post

Wednesday, April 13, 2016

Is the US Presidential race rigged?

Yesterday, in class, we discussed the current primary race. The link below is an article from BBC that discusses the delegate system and the issues that have come up as a result of the "fuzzy" delegate math. Do you think the United States election process is rigged? Do you think that there could be a better method of holding elections?

http://www.bbc.com/news/election-us-2016-36029381

Too Big to Fail or Too Big not to Fail?

After the financial crisis in 2008, Congress demanded that big banks regularly provide regulators with careful plans (called living wills) for how they would enter bankruptcy in an organized fashion. However, the Fed recently found that five major banks were "not credible" or "would not facilitate an orderly resolution" as required. Congress made this requirement to reduce the threat that another banking collapse would have on the entire economy. In other words these requirements were made to avoid and the "too big too fail argument". The Fed has given these banks until October 1st to fix their plans or else they will impose restrictions.

Why do you think major banks such as JPMorgan Chase and Bank of America, have not followed the regulations set upon them by Congress, and what do you think the appropriate punishment should be?

Also the "too big to fail" issue has been relevant in the presidential race, with those who want to break up banks using this as proof that large banks are too big and complicated and can still fail. What do you think about this argument and about the state of large banks.

http://www.nytimes.com/2016/04/14/business/dealbook/living-wills-of-5-banks-fail-to-pass-muster.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=first-column-region®ion=top-news&WT.nav=top-news

Why do you think major banks such as JPMorgan Chase and Bank of America, have not followed the regulations set upon them by Congress, and what do you think the appropriate punishment should be?

Also the "too big to fail" issue has been relevant in the presidential race, with those who want to break up banks using this as proof that large banks are too big and complicated and can still fail. What do you think about this argument and about the state of large banks.

http://www.nytimes.com/2016/04/14/business/dealbook/living-wills-of-5-banks-fail-to-pass-muster.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=first-column-region®ion=top-news&WT.nav=top-news

America's pathetic inability to punish the powerful

This is a section from a larger op-ed piece (see here) .

What happened was collective negligence and stupidity, not

outright individual criminality. Financial engineering is just

incredibly complex, and sometimes things go bad without anyone being

malicious.

What happened was collective negligence and stupidity, not

outright individual criminality. Financial engineering is just

incredibly complex, and sometimes things go bad without anyone being

malicious.

In the case of the Great Recession, however, this

narrative has become harder to defend. In the years since, several major

players like Bank of America and JPMorgan Chase have collectively paid (woefully inadequate) fines for various shenanigans. These decisions involved signed

statements of fact that reveal individuals within the companies knew

what was going on: Financiers were well-aware the mortgages in the

securities they were selling were bad, and that they were running

roughshod over proper guidelines for underwriting. All of which goes

beyond the negligent into the criminal.

narrative has become harder to defend. In the years since, several major

players like Bank of America and JPMorgan Chase have collectively paid (woefully inadequate) fines for various shenanigans. These decisions involved signed

statements of fact that reveal individuals within the companies knew

what was going on: Financiers were well-aware the mortgages in the

securities they were selling were bad, and that they were running

roughshod over proper guidelines for underwriting. All of which goes

beyond the negligent into the criminal.

But being in the capitalist aristocracy afforded a different kind of protection: The Department of Justice concluded

they couldn't risk prosecuting individual financial leaders for fear of

destabilizing the financial markets and thus the entire economy.

they couldn't risk prosecuting individual financial leaders for fear of

destabilizing the financial markets and thus the entire economy.

It seems hard to escape the conclusion that people on Wall Street weren't prosecuted largely because

they were part of the same communities as major government agency

heads: friends of friends and colleagues of colleagues, all part of the

same relatively small social circles that exist at the top of the income

ladder. To understand is to forgive, and the elite and the upper class

understand their own.

they were part of the same communities as major government agency

heads: friends of friends and colleagues of colleagues, all part of the

same relatively small social circles that exist at the top of the income

ladder. To understand is to forgive, and the elite and the upper class

understand their own.

Monday, April 11, 2016

Gender Wage Gap

Here's an interesting article discussing the gender wage gap in the United States. According to a new report released by congresswoman Carolyn B. Maloney, a woman in the workforce makes on average (the broadest estimate) 79% of what a man in the same position makes. For women of color, that drops to less than half of what their white, male counterparts make.

Aside from the obvious moral argument that men and women should receive equal pay for the same work, do you guys think the gender wage gap is affecting the economy, as the article suggests? Would equal pay regardless of gender boost the economy?

Aside from the obvious moral argument that men and women should receive equal pay for the same work, do you guys think the gender wage gap is affecting the economy, as the article suggests? Would equal pay regardless of gender boost the economy?

Who is leaving the labor force?

In this letter Robert Hall and Nicolas Petrosky-Nadeau discuss their recent research into the decline in the labor force. They find that in young workers (16-24) the decline has been among wealthier households and that this holds true all the way up to 54 years old. However, for people 55 and older those with the highest incomes are the most likely to keep working.

What do you think could be behind this trend? Is this likely to be a permanent change or is this an impact from the financial crisis? (or both I guess if it's a permanent change caused by the crisis)

What do you think could be behind this trend? Is this likely to be a permanent change or is this an impact from the financial crisis? (or both I guess if it's a permanent change caused by the crisis)

- Helicopter money: a few facts

I found a nice summary of the pros and cons of helicopter money, a proposed monetary policy that would further stimulate the economy. I can't imagine that the Fed would try it but I could see the ECB trying it.

From the article,

- Alpha.Sources - The (Impossible) Economics of Helicopter Money

From the article,

What makes helicopter money different from a conventional tax cut isThe author lists mechanisms that could be used to get the money to people. The interesting point that he makes (at least to me) is that the money would have to be rationed somehow because not every person would receive money. I can see so many ways that a rationing system could turn into a political game of increasing inequality.

that helicopter money is paid for by the central bank printing money,

rather than the government issuing debt.(...) helicopter money is actually the combination of two very familiar

policies: QE coupled with a tax cut. Another way of thinking about it:

instead of using money to buy assets (QE alone), the central bank gives

it away to people. If you think intuitively that this would be a better

use of the money as a means of stimulating the economy, I think you are

right.

- Alpha.Sources - The (Impossible) Economics of Helicopter Money

Sunday, April 10, 2016

Ford Investing in Mexico

Ford Motor Co. recently announced they will be investing in a new production plant in Mexico. (read about it here)

This move has taken some serious heat lately by those who believe Ford should have invested that money here and kept those jobs in the US. After all, Henry Ford himself very successfully implemented a plan that paid his workers high wages so that they could afford to buy the vehicles they were producing, therefore increasing the demand for Ford vehicles.

Contrasting opinions believe Ford is just making a smart business move to increase efficiency, as every good business does. (Read about it here)

What are your thoughts on this recent move by Ford? Would you do the same thing and invest in Mexico? Or would you keep the jobs here in the US?

This move has taken some serious heat lately by those who believe Ford should have invested that money here and kept those jobs in the US. After all, Henry Ford himself very successfully implemented a plan that paid his workers high wages so that they could afford to buy the vehicles they were producing, therefore increasing the demand for Ford vehicles.

Contrasting opinions believe Ford is just making a smart business move to increase efficiency, as every good business does. (Read about it here)

What are your thoughts on this recent move by Ford? Would you do the same thing and invest in Mexico? Or would you keep the jobs here in the US?

Too much to hope for?

Candidates for president have to have a lot of policies they endorse. As a result it can be pretty difficult to know what these policies will do to the economy. One person who everybody has been interested in is Bernie Sanders. How would a democratic socialist getting everything he wants impact the economy? Gerald Friedman tried to answer this question in a report using economic models (here's the link if you want, but I would not recommend reading it. It's 53 pages of dull). Since releasing this report though it has received some criticism. Actually quite a bit of criticism. Some would say a lot of criticism. And this isn't just from conservative writers either, this is coming from progressive policy wonks like Paul Krugman. They highlight three main findings of the paper to be unrealistic:

1. It claims his policies will result in 5.3% growth in GDP

2. It claims unemployment will fall to 3.8%

3. At the same time unemployment is falling so low, it claims that the labor force participation will return to levels from 1999-2000.

What do you think? Are these results too optimistic? Or are these the extreme results we should expect from an extremely different policy?

Why not buy yourself a politican or two?

From an interview with a large donor:

Here’s how Hoffman puts it: “Large donors … often serve as an

executive board of sorts, challenging campaigns to act worthy of their

investment.” Hoffman writes, “Trump brags that he is without big donors. That may

be true. But it also means he is without restraint. … In business and

politics alike, oversight is a good thing.” If you’re not paying close attention, that makes the whole process

sound public-spirited and inspiring. If you are, however,

you realize Hoffman is telling us that he and his cohort see their money

as buying them seats on the board of a corporation they ultimately

control.

Hoffman acknowledges a possible downside of the system: “Raising

seven figures for a candidate grants you access that the average voter

will never see. This unfairness has been a source of major voter ire

this cycle. Injustice makes people angry. And it is angry voters who

have been pulling levers for Trump.” But he dismisses it in favor of an even loftier goal. Big donors

aren’t just backing a candidate, he says; they’re also investing in

their ideology.

Super PAC Backer Says Big Money Entitles Donors to Campaign “Oversight”

Here’s how Hoffman puts it: “Large donors … often serve as an

executive board of sorts, challenging campaigns to act worthy of their

investment.” Hoffman writes, “Trump brags that he is without big donors. That may

be true. But it also means he is without restraint. … In business and

politics alike, oversight is a good thing.” If you’re not paying close attention, that makes the whole process

sound public-spirited and inspiring. If you are, however,

you realize Hoffman is telling us that he and his cohort see their money

as buying them seats on the board of a corporation they ultimately

control.

Hoffman acknowledges a possible downside of the system: “Raising

seven figures for a candidate grants you access that the average voter

will never see. This unfairness has been a source of major voter ire

this cycle. Injustice makes people angry. And it is angry voters who

have been pulling levers for Trump.” But he dismisses it in favor of an even loftier goal. Big donors

aren’t just backing a candidate, he says; they’re also investing in

their ideology.

Super PAC Backer Says Big Money Entitles Donors to Campaign “Oversight”

Saturday, April 9, 2016

Indentured servitude????

Purdue University has started a program where a student can pledge a 4-5% of their future income for a set period of years as collateral for a loan today.

Getting a Student Loan With Collateral From a Future Job - The New York Times

Since upwards of 40% of borrowers aren't making payments after school (see Wall Street Journal story here), lenders are looking for a different model.

Wouldn't it be better to make education more affordable through subsidies and tax incentives?

Getting a Student Loan With Collateral From a Future Job - The New York Times

Since upwards of 40% of borrowers aren't making payments after school (see Wall Street Journal story here), lenders are looking for a different model.

Wouldn't it be better to make education more affordable through subsidies and tax incentives?

Job Market

Here's a couple of articles discussing the current job market in the US.

NY Times Washington Post

What are your thoughts on the job market? As a senior on track to graduate, are you feeling confident that you'll be able to find a job in your field? Has your confidence in the job market changed over the past couple of years?

Also, take a look at the infographic titled "Job Success, By Major" in the NYT article. You'll notice economics majors are doing fairly well, around the top third of the majors listed, but not quite as well as nursing or engineering majors. Why do you think Econ majors are where they are on the list?

I'm interested to hear everyone's thoughts, since many of us have been (or still are) job searching in the past few months.

Expensive to be poor