From Trulia,

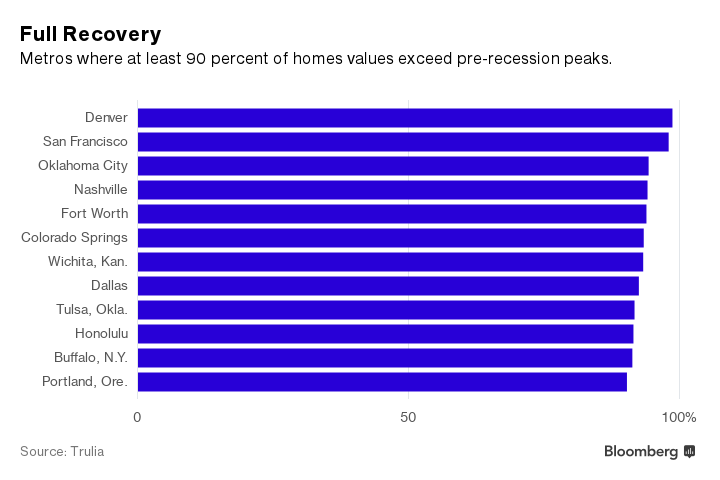

a zip code-level analysis offers a more nuanced view of the haves and have-nots. In much of the middle of the country, cities have stagnated while less populated regions lead the recovery. While it’s true coastal markets have experienced the lion’s share of appreciation, the majority of homes in pricey markets like New York, Los Angeles, Silver Spring, Maryland, and Fairfield County, Connecticut, are still worth less than a decade ago.

This comment has been removed by the author.

ReplyDeleteI think the "Left Behind" chart is a good indicator of why the presidential election turned out the way it did. Most of the areas facing a lag in recovery are in rural America (Rust Belt), and clearly, they did not experience a better economy under the previous administration. This probably influenced their vote heavily. Interesting how such data was ignored during the election.

ReplyDeleteInteresting how we have not yet recovered fully from the housing crisis but we are still engaging in the same practices that got us in trouble in 2008, as we saw from the movie.

ReplyDeleteI agree with Kriti!

ReplyDeleteLike how they showed at the end of "The Big Short", CDO's are being sold again under a new name as of 2015. The name,"bespoke tranche opportunity" will steer us towards a familiar path unfortunately.

ReplyDeleteI like what Adam said, it's kind of sad to see our greed and want for more money driving people to start doing the same things that got us into the mess we are in.

ReplyDelete