http://www.ritholtz.com/blog/2015/04/high-number-of-zero-savers/

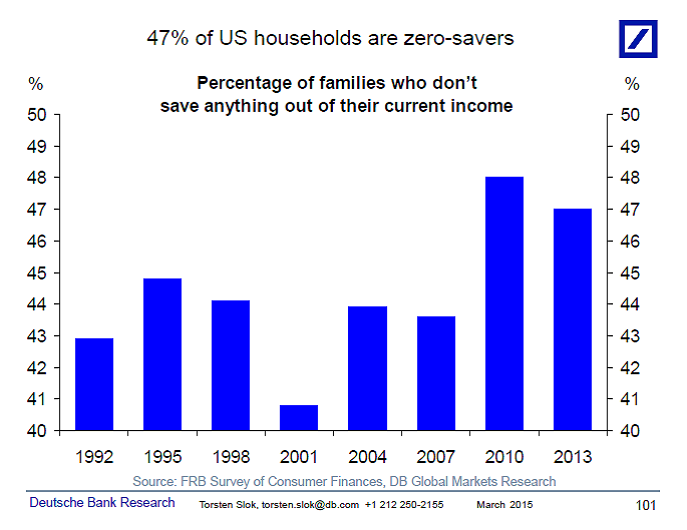

http://www.ritholtz.com/blog/2015/04/high-number-of-zero-savers/ They aren't saving to buy a house, for retirement, education, or anything. On the other hand, they are slowly paying down credit cards and other household debt (see this Fed data link).

Yikes! That is scary. Money is tight but just putting away 10% of income a week would be better than nothing. I'm glad to see that the number has decreased slightly from 2010 but 47% is a big number. On the other hand, that means that household's are consuming more which is better for overall growth in the economy which will lead to higher wages so that has a positive side, but still for a household you want some security if something happens.

ReplyDeleteWow, that is a shocking number. Besides the recession, is this number the result of interest rates being so low for so long?

ReplyDeleteThis is definitely not what I expected, especially after hearing how important it is to build up some savings. I guess paying off debts is a good thing but I wonder how much of that debt is as a result from the financial crisis?

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis is really surprising! Why are households not saving? are living expenses too high or is it because of the lower interest rates or insufficient incomes?

ReplyDelete