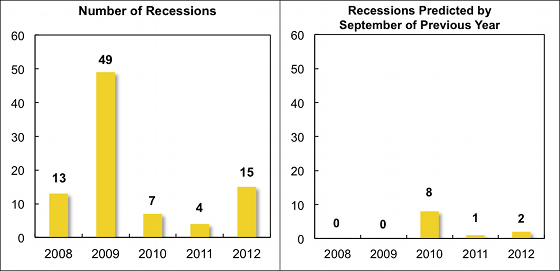

The panel on the right shows the number of cases in which forecasters

predicted a fall in real GDP by September of the preceding year. These

predictions come from Consensus Forecasts, which provides for

each country the real GDP forecasts of a number of prominent economic

analysts and reports the individual forecasts as well as simple

statistics such as the mean (the consensus).

As shown above, none of the 62 recessions in 2008–09 was predicted as

the previous year was drawing to a close. However, once the full

realisation of the magnitude and breadth of the Great Recession became

known, forecasters did predict by September 2009 that eight countries

would be in recession in 2010, which turned out to be the right call in

three of these cases. But the recessions in 2011–12 again came largely

as a surprise to forecasters.

“There will be growth in the spring”: How well do economists predict turning points? | naked capitalism

I found this article to be very interesting, as it provided data for something I think most people would intuitively think. The economies of nations nowadays are exceptionally complex, and I find it nearly impossible that any model could reliably make predictions about future events. I am curious as to what inputs these models have and what constitutes tail events (in reference to the 2nd bullet point under 'Searching for an Explanation'). Despite the unreliability of these forecasts, I find it interesting that they still can stir the markets and investor confidence.

ReplyDeleteOn another note, at the end of the reading for this week, a graph is provided that forecasts data about the US debt until about 2087, if I remember correctly. I saw this and was extremely skeptical at first, but thankfully the author was clear about how absurd such a forecast is.

This is not just about economic predictions. Predictions in general are a risky concept to get involved in. Its almost like trying to predicting who is going to win the World Series or the Super Bowl. Its almost impossible to be correct on a prediction because, as Sanjay mentioned, economies are so complex. Another piece of puzzle with predictions is accurate statistics. Those who took econometrics with Professor McKinney know that those are hard to come by.

ReplyDeleteI agree with Mark. Isaac Newton once said, "I can calculate the movement of heavenly bodies but not the madness of men" when talking about how he struggled in investing. I think Keynes had similar problems. I think the main problem that prevents economics from becoming a true science is that you can never accurately predict what human beings will do in the future.

ReplyDeleteI agree with Hikaru in that predicting human behavior is incredibly difficult, however for a different reason. I think the main problem preventing economists from predicting future events is that once one of their predictions is accepted as credible it will change human behavior. For example, if an economist accurately predicted the housing bubble and the theory was universally accepted, bankers and investors would not have made the decisions that eventually led to the bubble.

ReplyDelete