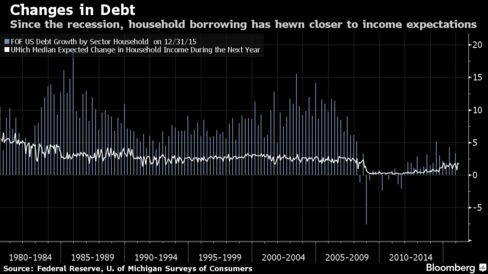

We have talked about most of the points in this article but I like the charts so here we go again. In both cases, living standards took a hit. Between 2000 and 2007,

borrowed money was adding about $330 billion a year to Americans’

purchasing power, according to the Federal Reserve Bank of New York. By

2009, households were diverting $150 billion to pay back debt — a swing

of almost half a trillion dollars, even without counting the impact of

lost jobs....

Consumers borrow less which means that consumption and GDP growth is lagging.

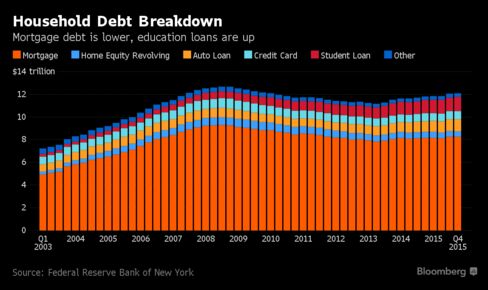

Policy makers wouldn’t want a repeat of the borrowing binge anyway. The

question is: What fills the gap? Fiscal spending isn’t doing it. The

government has scaled back its post-crisis stimulus; business investment

is slowing; and wage increases during this recovery are only barely

outpacing inflation.

All of this puts a drag on economic growth. Again, the Kenny's and Jay's are doing fine while everyone else has less than before the Great Recession.

Just like the article above says, business investment has been slow, consumers are focused to pay off their debts rather than spending, and government is not spending enough money to stimulate economy. The economic slack caused by lagging demand has been improved in the unemployment rate because it has decreased to 5.0% and in the output gap that is going to be less 2% in 2016. However, shrinking the output gap has been challenged by deteriorating potential gap according to this article that I found. The author of this article argues that the government should take an expansionary fiscal stance rather than fiscal austerity to boost economy since we are on "secular stagnation—a chronic shortfall of aggregate demand." Theoretically, this policy should improve economy, but I'm not so sure whether it would spark wage and price inflation. Where is the money for the government to spend in the first place?

ReplyDeletehttp://www.epi.org/publication/mission-still-not-accomplished-to-reach-full-employment-we-need-to-move-fiscal-policy-from-austerity-to-stimulus/